Germany's Benefit from the Greek Crisis

This note shows that the German public sector balance benefited significantly from the European/Greek debt crisis, because of lower interest payments on public sector debt. This is due to two effects.

10. August 2015

Immer mehr Menschen sehen, dass das Wohlstandsversprechen des europäischen Projekts nicht mehr lange zu halten ist.

(Foto: REUTERS)Inhalt

Seite 1

Bad news in Greece trigger flight into German bundsSeite 2

Counterfactual yields on German bunds without flight-to-safetySeite 3

The gains from the safe-haven effect Auf einer Seite lesenOne, in crisis times investors disproportionately seek out safe investments (“flight to safety”), bidding down the returns on safe-haven assets. We show that German bunds strongly benefited from this effect during the Greek debt crisis. Second, while the European Central Bank (ECB) monetary policy stance was quite close to an “optimal” monetary policy stance for Germany from 1999 to 2007, during the crisis monetary policy was too accommodating from a German perspective, due to the emerging disparities across the Euro area. As a result of these two effects, our calculations suggest that the German sovereign saved more than 100 billion Euros in interest expenses between saved more than 100 billion Euros in interest expenses between 2010 and mid-2015. That is, Germany benefited from the Greek crisis even in case that Greece defaults on all its debt (a total of 90 billions) owed to the German government via diverse channels (European Stability Mechanism [ESM], International Monetary Fund [IMF], or directly).

In the following, we will document in Section 2 the direct effects news in Greece had on German government bond yields by looking at specific events in the past, providing evidence for an effect of flight-to-quality or flight-to-liquidity. In order to assess the amount of savings to the German budget that may have resulted from this, we develop two different measures for counterfactual yields without such a flight effect in Section 3. These counterfactual yields (traded on secondary markets) are then combined with newly issued debt on primary markets in Section 4, resulting in estimates of the gains for the German sovereign. As argued there, these estimates are most likely very conservative.

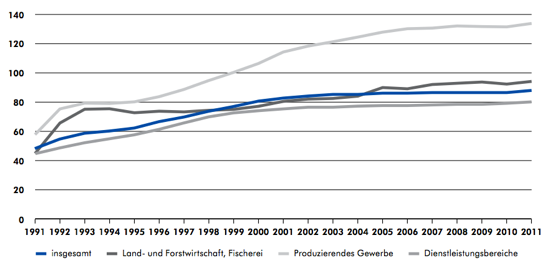

Savings for different scenarios by year of issuance

Quelle: Statistisches Bundesamt; Darstellung des IWH.

Bad news in Greece trigger flight into German bunds

Bad news in Greece was good news for Germany and vice versa. Faced with market uncertainty, investors shift their portfolios towards safe assets, for example countries with high credit ratings. This is the so-called flight-to-safety effect. Similarly, investors may also shift their portfolios towards assets that are more actively traded (flight-to-liquidity). Both effects have been analyzed in theoretical models (e.g. Vayanos (2004) and documented empirically for an earlier episode in the European government bond market by Beber et al. (2009). The Appendix reports the most important news from Greece between October 2014 and July 2015 and its effect on German ten-year bond yields.

With this information in hand, we can proceed to calculate the annual interest savings

During this time, the conservative Greek government searched for a new president who would be appealing to the parliament. Having failed, it called elections which were easily won by the radical left in January 2015. After winning the election, the new Syriza government stopped many of the reforms imposed on previous governments by creditors, arguing that austerity had only hurt the Greek population in the past. However, in the dramatic negotiations on continuing reforms and support by the Euro area (including the first default by an advanced economy on IMF loans in the beginning of July 2015), the Greek government had to agree to even harsher austerity measures than before. We see that every time an event made agreement on a reform package less likely Germany’s Benefit from the Greek Crisis 2 (and a Grexit more likely), German government bond yields fell and each time an event increased the likelihood of an agreement on package, German government bond yields increased . Cumulatively, bad news for Greece resulted in a decline of German ten-year bund yields of more than 1.5%. The effect is symmetric: Good news for Greece resulted in increases in German bund yields of about equal magnitude.