Governance und Finanzierung

Diese Forschungsgruppe untersucht traditionelle und moderne Ansichten über Corporate Governance auf den Finanzmärkten. Sie trägt dazu bei, die Wirksamkeit verschiedener Governance-Mechanismen bei der Auswahl von Talenten, der Schaffung von Anreizen und der Bindung an das Unternehmen zu verstehen. Die Gruppe untersucht auch, wie verschiedene Stakeholder die Corporate Governance beeinflussen.

Forschungscluster

Finanzresilienz und RegulierungIhr Kontakt

- Abteilung Finanzmärkte

Referierte Publikationen

Hedge Fund Activism and Internal Control Weaknesses

in: China Accounting and Finance Review, Nr. 4, 2022

Abstract

Purpose: The aim of the paper is to investigate the associations between hedge fund activism and corporate internal control weaknesses. Design/methodology/approach: In this paper, the authors identify hedge fund activism events using 13D filings and news search. After matching with internal control related information from Audit Analytics, the authors utilize ordinary least square (OLS) and propensity score matching (PSM) to analyze the data. Findings: The authors find that after hedge fund activism, target firms report additional internal control weaknesses, and these identified internal control weaknesses are remediated in subsequent years, leading to better financial-reporting quality. Originality/value: The findings indicate that both managers and activists have incentives to develop a stronger internal control environment after targeting.

On Modeling IPO Failure Risk

in: Economic Modelling, April 2022

Abstract

This paper offers a novel framework, combining firm operational risk, IPO pricing risk, and market risk, to model IPO failure risk. By analyzing nearly a thousand variables, we observe that prior IPO failure risk models have suffered from a major missing-variable problem. Evidence reveals several key new firm-level determinants, e.g., the volatility operating performance, the size of its accounts payable, pretax income to common equity, total short-term debt, and a few macroeconomic variables such as treasury bill rate, and book-to-market of the DJIA index. These findings have major economic implications. The total value loss from not predicting the imminent failure of an IPO is significantly lower with this proposed model compared to other established models. The IPO investors could have saved around $18billion over the period between 1994 and 2016 by using this model.

Stock Liquidity and Corporate Labor Investment

in: Journal of Corporate Finance, February 2022

Abstract

Labor is among the most crucial factors of production that maintain a firm's competitiveness. Given its economic importance, drivers of firms' labor investment policy have gained increasing attention in the financial economics literature. This study investigates the relation between stock liquidity and labor investment efficiency. We establish a causal relation between the two phenomena using an exogenous shock to liquidity: the 2001 decimalization of stock trading. We find that labor investment efficiency improves following an increase in stock liquidity, and the effect is prevalent in firms experiencing overinvestment in labor. Our findings further support the argument that stock liquidity improves the efficiency of labor investment by enhancing governance through shareholder exit threat.

CEO Network Centrality and the Likelihood of Financial Reporting Fraud

in: Abacus, Nr. 4, 2021

Abstract

This paper investigates the association between CEO’s relative position in the social network and the likelihood of being involved in corporate fraud. Tracing a large sample of US publicly listed firms, we find that CEO network centrality is inversely related to the likelihood of fraudulent financial reporting. We also document a significant spillover effect of financial reporting behaviour from the dominant (most central) CEO to other CEOs in the same social network, suggesting that the ethical corporate behaviour of CEOs is, on average, influenced by that of their dominant CEO in the network. We further find that the role of CEO network centrality in reducing fraud risk is more prominent in firms with lower auditor quality. Overall, our results suggest that network centrality is an important CEO trait that promotes ethical financial reporting behaviour within social networks.

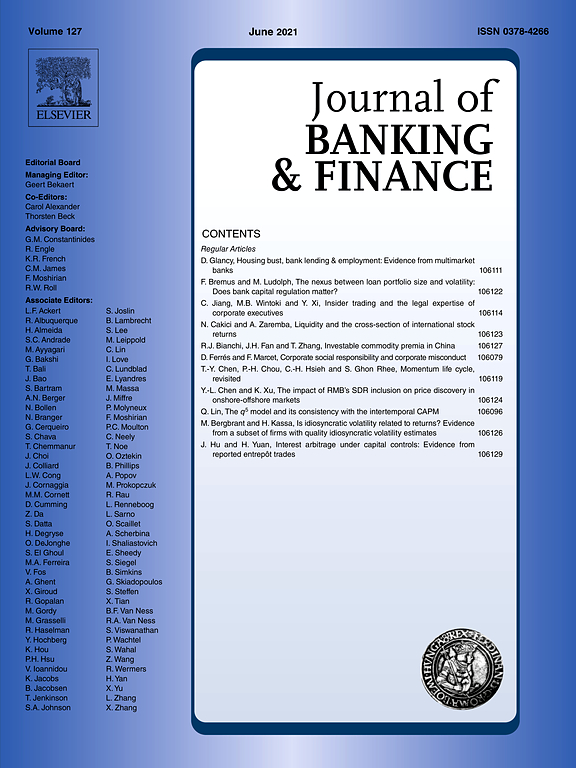

Executive Equity Risk-Taking Incentives and Firms’ Choice of Debt Structure

in: Journal of Banking and Finance, December 2021

Abstract

We examine how executive equity risk-taking incentives affect firms’ choice of debt structure. Using a longitudinal sample of U.S. firms, we document that when executive compensation is more sensitive to stock volatility (i.e., has higher vega), firms reduce their reliance on bank debt financing. We utilize the passage of the Financial Accounting Standard (FAS) 123R option-expensing regulation as an exogenous shock to management option compensation to account for potential endogeneity. In cross-sectional analyses, we find that the documented effect of vega is amplified among firms with higher growth opportunities and more opaque financial information; we also find vega's effect is mitigated in firms with limited abilities to tap into public debt market. Supplemental analyses suggest that firms with higher vega face more stringent bank loan covenants. We conclude that, by encouraging risk-taking, higher vega reduces firms’ reliance on bank debt financing in order to avoid more stringent bank monitoring.

Arbeitspapiere

The Liquidity Premium of Safe Assets: The Role of Government Debt Supply

in: IWH Discussion Papers, Nr. 11, 2017

Abstract

The persistent premium of government debt attributes to two main reasons: absolute nominal safety and liquidity. This paper employs two types of measures of government debt supply to disentangle the safety and liquidity part of the premium. The empirical evidence shows that, after controlling for the opportunity cost of money, the quantitative impact of total government debt-to-GDP ratio is still significant and negative, which is consistent with the theoretical predictions of the CAPM with utility surplus of holding convenience assets. The relative availability measure, the ratio of total government liability to all sector total liability, separates the liquidity premium from the safety premium and has a negative impact too. Both theoretical and empirical results suggest that the substitutability between government debt and private safe assets dictates the quantitative impact of the government debt supply.

Censored Fractional Response Model: Estimating Heterogeneous Relative Risk Aversion of European Households

in: IWH Discussion Papers, Nr. 11, 2015

Abstract

This paper estimates relative risk aversion using the observed shares of risky assets and characteristics of households from the Household Finance and Consumption Survey of the European Central Bank. Given that the risky share is a fractional response variable belonging to [0, 1], this paper proposes a censored fractional response estimation method using extremal quantiles to approximate the censoring thresholds. Considering that participation in risky asset markets is costly, I estimate both the heterogeneous relative risk aversion and participation cost using a working sample that includes both risky asset holders and non-risky asset holders by treating the zero risky share as the result of heterogeneous self-censoring. Estimation results show lower participation costs and higher relative risk aversion than what was previously estimated. The estimated median relative risk aversions of eight European countries range from 4.6 to 13.6. However, the results are sensitive to households’ perception of the risky asset market return and volatility.