Inhalt

Seite 1

IntroductionSeite 2

Political Lending CyclesSeite 3

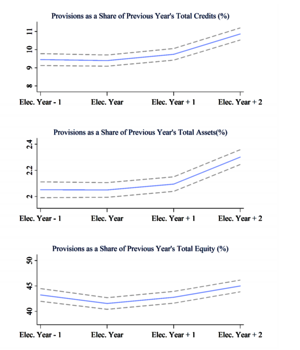

Credit Quality Auf einer Seite lesenPolitical Lending Cycles

Political business cycle theories describe politicians' incentives towards expansionary fiscal policies prior to the elections in order to increase their own popularity via better perceived economic conditions. Theories predict that politicians myopically try to reach the minimum unemployment rate at the onset of the elections, but when the election is over, they engage in deflationary policies to combat the consequent price surges (Nordhaus [1975]). We show that this behaviour also exists in German counties, where the local politicians use the savings banks' resources in order to engage in expansionary policies prior to the elections.

We use the balance sheet information of 452 German savings banks from 1995 till 2006 and combine it with county electoral data at the state level to study the differential lending behaviour of banks during election years and more importantly the performance of loans that are extended during the election period. The county elections in Germany are state-wide, i.e. all counties in one of the 16 German states hold elections at the same time. Throughout our sample period in each year, except for 2000 and 2005, there are elections in at least one and at most nine states. This cross-sectional and time series variation in election dates allows us to control for business cycle effects in Germany, because we can compare observations in states with elections to observations in states without. Moreover, by controlling for bank fixed effects, we compare each savings banks' credit supply in election years with its own credit supply in other years. We also control for time-varying regional economic conditions, namely debtper-capita growth and GDP-per-capita growth. This lets us control for common regional economic shocks and time trends. All the variables that we use in this study are defined as presented in Table 1. The summary statistics are presented in Table 2.

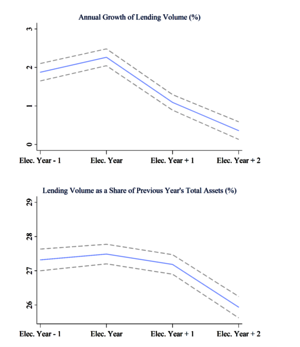

We start by plotting annual growth rate of total lending volume and lending volume as a share of last year's total assets for the electoral cycle.2 Figure 1 shows the annual growth rate of total lending for the election years, one year prior to the election and the two years after it.

Table 1: Variable definitions

Table 2: Summary statistics

In Figure 2, we do the same for total lending as a share of last year's total assets. Both these graphs show that during the election year, there is a sizeable increase in credit extended by local savings banks. In order to estimate the magnitude of the political lending effect, we run regressions of annual growth rate of total lending volume and lending volume as a share of last year's total assets on election year dummies and bank and regional-level control variables. The results are presented in Table 3. All specifications show a significantly positive coefficient for election years. To see how big such effects are, let's first consider the annual lending growth.

Here the most conservative estimate shows a 0.7 percentage points higher growth rate for lending during election years. From Table 2, we learn that the average annual growth rate of total lending is 1.65%. Therefore, the estimate tells us that during the election years, lending grows almost 40% faster than it grows in non-election years. Our estimates for lending as a share of total assets show that in election years, total lending as a share of total assets is about 0.17 percentage points higher than in normal years. Again, since we know that the average loan-to-assets ratio for savings banks is 27.1% and the size of the average bank is €1.65 billion, this estimate implies that during the election years, the average bank generates €7.6 million more loans in comparison to a non-election year.