Inhalt

Seite 1

IntroductionSeite 2

Data and Summary StatisticsSeite 3

ResultsSeite 4

Endnoten Auf einer Seite lesenData and Summary Statistics

We compile a monthly panel of eurozone countries from January 2019 to August 2020 to measure the extent to which precautionary savings, reduced consumption opportunities, and Ricardian Equivalence can explain the rise in household savings. Because savings rates are only available at the quarterly level, we use monthly household deposits from the European Central Bank’s (ECB) Statistical Data Warehouse as a proxy that we then seasonally adjust.

While households can increase net savings by investing, reducing their debt, or holding currency, deposits should capture the majority of month-to-month changes in savings and are conveniently available on a monthly frequency for euro area members. Dossche and Zlatanos (2020) show that while currency in circulation has increased and household debt has declined, by far the most important driver of the increase in savings rates is household deposits.5

We measure government lockdown stringency using the Oxford COVID-19 Government Response Tracker (OxCGRT), which tracks comparable policy measures of government COVID-19 response measures across countries and time from January 2020 to today.6 We take the monthly average of all nine containment and closure policies by country and divide this value by the sample maximum, such that the country-month observation with the strictest set of containment policies equals one. We assign all observations prior January 2020 a lockdown stringency value of zero.

To capture variation in precautionary motivations for savings, similar to the approach of Dossche and Zlatanos (2020), we retrieve the seasonally adjusted households’ self-reported unemployment expectations over the next twelve months from the European Commission’s Consumer Survey Questionnaire. The index varies from –100 to +100 with a long-run average of 0. We argue that such a measure should be superior to using the realised level of unemployment for capturing precautionary motivations, as it captures households’ expectations about the future, which should be more important in explaining consumption and savings behaviour today.

We capture variation in the growth rate of government debt using total government debt securities divided by GDP. Total government debt securities are sourced from the ECB Statistical Data Warehouse. Using debt securities systematically underestimates the total level of debt in countries which rely on sources of financing beyond government bonds. However, over this period, there have been no international bailout loans to national eurozone governments that would not be captured by debt securities, so there should be little mismeasurement of changes in government debt for our sample.

Our sample consists of all eurozone members with populations greater than one million. All time series variables are seasonally adjusted using X-12-ARIMA. The sample period runs from January 2019 to August 2020, yielding 257 country-month observations with non-missing values for all variables.

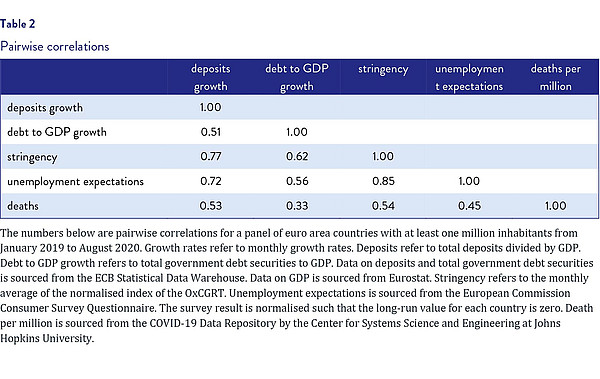

Table 1 presents summary statistics for our sample. Both the stringency measure and death per million are strongly rightward skewed in their distribution, as the sample period covers at least 13 months of times before the COVID-19 crisis arrived in Europe.

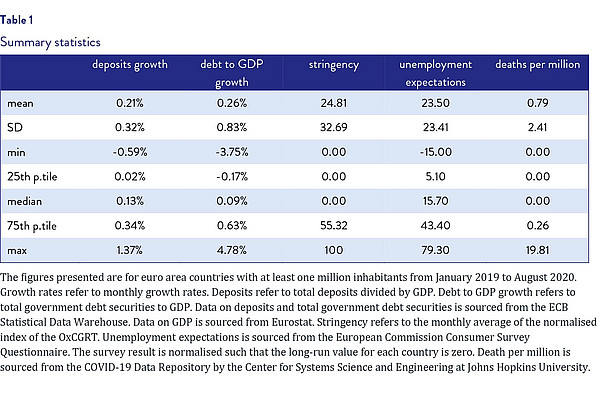

Table 2 displays pairwise correlations of the various variables included in the model. Straightaway, we observe that the variable most correlated with the deposit rate growth is the lockdown stringency index, followed closely by unemployment expectations. Moreover, the highest pairwise correlation of variables in the table is between the stringency index and unemployment expectations, perhaps reflecting both the impact of the lockdown on economic activity, but also the lockdown’s importance in forming households perceptions. Interestingly, we observe that the correlation between unemployment expectations and the stringency measure is greater than that of unemployment expectations and GDP growth. This could suggest that the lockdown may be more salient in forming the public’s perception of changes in economic activity than actual changes in economic activity.