Significant Cooling of the Economy – Political Risks High: Joint Economic Forecast Spring 2019

Die Konjunktur in Deutschland hat sich seit Mitte des Jahres 2018 merklich abgekühlt. Der langjährige Aufschwung ist damit offenbar zu einem Ende gekommen. Die schwächere Dynamik wurde sowohl vom internationalen Umfeld als auch von branchenspezifischen Ereignissen ausgelöst. Die weltwirtschaftlichen Rahmenbedingungen haben sich – auch aufgrund politischer Risiken – eingetrübt, und das Verarbeitende Gewerbe hat mit Produktionshemmnissen zu kämpfen. Die deutsche Wirtschaft durchläuft nunmehr eine Abkühlungsphase, in der die gesamtwirtschaftliche Überauslastung zurückgeht. Die Institute erwarten für das Jahr 2019 nur noch ein Wirtschaftswachstum von 0,8% und damit mehr als einen Prozentpunkt weniger als noch im Herbst 2018. Die Gefahr einer ausgeprägten Rezession mit negativen Veränderungsraten des Bruttoinlandsprodukts über mehrere Quartale halten die Institute jedoch bislang für gering, jedenfalls solange sich die politischen Risiken nicht weiter zuspitzen. Für das Jahr 2020 bestätigen die Institute ihre Prognose aus dem vergangenen Herbst: Das Bruttoinlandsprodukt dürfte im Jahr 2020 um 1,8% zunehmen.

04. April 2019

The economic situation varies considerably from region to region: in the US, the upswing merely slowed down, whereas in the euro area, it came to a standstill in the second half of 2018, mainly due to the pronounced weakness of German and Italian industry. Signs of an economic slowdown in China came in the early part of last year, but only the country’s very weak imports in the final quarter of 2018 suggest a downturn there.

To some extent, the cooling of the global economy in the course of 2018 is better understood as a normalisation after the exceptionally strong upswing in 2017. However, it is also a consequence of major economic policy risks. It is still not clear how the trade conflict pitting the US against China and the European Union (EU) will play out. The second uncertainty in Europe is the UK’s withdrawal from the EU. It is unclear whether this will be regulated by an agreement or unregulated, or if and for how long it will be postponed.

The international economy also faced a headwind in the form of US monetary policy. In 2018, the US Federal Reserve raised its key interest rate by a total of one percentage point to a range of 2.25–2.5%, and as a result financing conditions in many emerging markets deteriorated significantly at times. Other dampening one-off effects in the third quarter of 2018 included natural disasters in Japan and weak vehicle sales in many places, partly due to difficulties in converting to a new exhaust gas testing system in the EU and elsewhere.

It is not only in the automotive sector, but also in manufacturing in general that the economy has cooled off sharply. This may be partly because duties or risks of tariff increases usually affect trade in goods, but not in services. At any rate, the mood in manufacturing companies in almost all countries has deteriorated much more dramatically than among service providers, and world industrial production has lost considerably more momentum than the economy as a whole. Not least because the service sector remains intact, employment in most advanced economies has expanded until recently, albeit at a slower pace, and wage growth has tended to accelerate, with unemployment often very low. However, except for oil-price-related fluctuations, consumer price inflation remains generally low (as in the euro area and in particular Japan) or moderate (as in the US).

Against this backdrop, monetary policy in many places has reacted to the economic slowdown and suspended or loosened the tightening course previously adopted. The US Federal Reserve announced its change of course in January 2019, the European Central Bank (ECB) in March. However, as early as the end of 2018, players in financial markets were no longer expecting near-term hikes in key interest rates in the US, and capital market yields have tended to decline since then. A return to more favourable financing conditions is of particular benefit to emerging markets, which are dependent on inflows of foreign capital.

Fiscal policy varies from region to region. In the US, it is less expansionary, with the stimuli from the tax reform adopted at the end of 2017 and from spending programmes expiring in the forecast period. An increase in Japanese VAT in the autumn of 2019 will have a restrictive effect. In contrast, fiscal policy in the euro area will change this year from being more or less neutral to being slightly expansionary, mainly due to measures taken in Germany and Italy. Finally, the Chinese government has decided to introduce substantial tax cuts for consumers and companies in order to stabilise its economy.

Economic policy will therefore generate opposing stimuli in the forecast period: on the one hand, monetary and fiscal policy will support the international economic situation; on the other, high levels of uncertainty about the progress of the trade disputes and the UK’s withdrawal from the EU continue to weigh on the global economy. Leading indicators, for example, do not paint a clear picture of the international economy in the first half of 2019: the mood in industry has fallen until recently, as have incoming orders. In addition, US production in the first quarter is likely to have been significantly dampened by the government shutdown in January and the severe cold in February. However, other indicators also point to the possibility that the economic cycle has bottomed out: share prices and prices for many industrial commodities rose again at the beginning of the year, and risk premiums – measured by the yield spread between otherwise comparable bonds issued by issuers with different levels of risk – fell. In addition, consumer confidence in advanced economies in general remains high. The upswing in the US will probably continue for some time despite temporary dampening effects and the economic policy measures in China are likely to gradually take effect. Taken together, these facts also point to a somewhat stronger expansion of production in the further course of this year. Furthermore, it is to be expected that the economies of some emerging countries will pick up again in the current year after slowing significantly in 2018.

In 2020, US and euro area production will expand close to their potential, while the trend towards somewhat lower growth in China will continue. All in all, it is to be expected that overall economic production in the countries considered here will increase at a rate of 2.7% (weighted by exchange rate) in 2019 and 2020, which is significantly slower than in 2018. Compared with the Joint Economic Forecast for autumn 2018, this represents a downward revision of 0.3 and 0.2 percentage points, respectively. The slowdown is even more pronounced from a German perspective (world production weighted by the shares of German exports). World trade in 2019 is likely to be only 1.6% higher than in 2018, but will pick up noticeably over the course of the year.

The German economy has cooled noticeably since mid-2018. With economic output stagnating in the second half of the year, the long-term upswing has apparently come to an end. This weaker momentum was triggered both by the international environment and by industry-specific events. The global economic environment has deteriorated, due in part to political risks, and this is adversely affecting German exports. However, the main factors exacerbating the slowdown in the second half of 2018 were problems in the automotive industry and the low water level of the Rhine. Still, a slower rate of expansion had already become apparent due to production bottlenecks; the proportion of companies reporting production obstacles due to supply bottlenecks and a shortage of skilled workers had reached historic highs by the middle of last year.

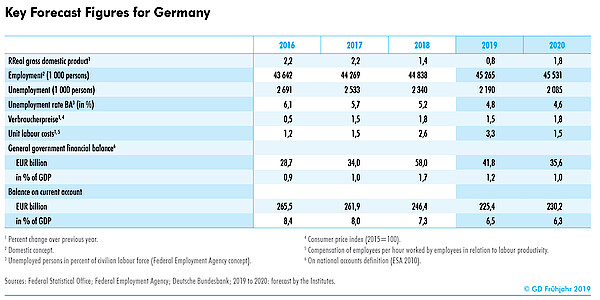

Germany’s economy is currently going through a cooling-off phase in which capacity shortages in the economy as a whole are declining. In the autumn 2018 report, the institutes had already pointed out that the upswing was losing momentum due to the harsher global economic climate; however, both the extent of domestic obstacles to production and the cooling of the global economy were underestimated. Overall, there has been a significant downward revision of forecasts – the institutes now expect economic growth of only 0.8% for 2019, more than one percentage point less than in autumn 2018. However, so far the institutes consider the danger of a pronounced recession with negative rates of change to GDP over several quarters to be low, at least as long as the political risks do not intensify further. The 68% prediction interval for 2019 ranges from 0.1–1.5%.

In 2019, the economy will probably stabilise, but without returning to the high momentum of previous years. The production problems caused by the low water level in the Rhine have been resolved, and the automotive industry should soon overcome its difficulties in switching over to the WLTP standard. This in itself would argue for a strong increase in production in the manufacturing sector. However, recovery in vehicle production has so far been sluggish. One factor here was that manufacturers and dealers apparently built up large stocks, thus delaying the production response to the return of higher sales figures. In addition, the industrial economy as a whole has weakened noticeably, especially since sales opportunities on foreign markets have been drying up. This is reflected in subdued order intake and a significant deterioration in the manufacturing sector’s business expectations. The institutes expect production here to recover only slightly after a further decline in the first quarter of 2019. Expansion in the construction industry is likely to continue to be limited by capacity bottlenecks. Consumer-related services are supporting the economy as they benefit from the significant rise in disposable income. All in all, GDP growth in the first quarter is likely to remain modest at 0.2%. As for the rest of the year, the pace of expansion is likely to pick up somewhat, with industrial production tending upwards again.

Low GDP growth in 2019 is due to the weak momentum at the turn of the year. However, the economic outlook is not as bleak as this rate might suggest. The institutes estimate the average annualised quarterly growth rate, which reflects the change in GDP over the four quarters of 2019, to be 1.4% and thus close to the potential growth rate of the German economy. The institutes are holding firm to their GDP forecast for 2020. Of the expected 1.8% increase, 0.4 percentage points are due to the higher number of working days available in 2020 than in 2019.

Employment growth is expected to lose momentum. Although the first quarter of 2019 should see another strong surge in the number of jobs, after that the pace is likely to slow considerably. Labour shortages continue to plague many sectors of the economy; elsewhere, especially in manufacturing, the economic slowdown will have an impact on employment. The institutes expect 430,000 more people to find employment in 2019 and another 265,000 to do so in 2020, following the increase of 570,000 in 2018. The unemployment rate will drop from 5.2% last year to 4.8% (2019) and 4.6% (2020). In light of the persistent labour market tensions in many areas, effective hourly earnings are likely to continue their climb, rising 2.8% this year and 2.4% next year, despite weak productivity growth.

Disposable income of private households will keep rising over the forecast period at a rate comparable to that of the past two years. Although the rise in gross wages is weakening in view of the slowing employment momentum, the return to parity financing of health insurance contributions as well as tax relief in the current year will result in net wages rising by 4.6% – about the same rate as in the previous year. Only next year will growth be noticeably lower at 3.4%, despite further relief. Monetary social benefits will increase sharply in the current year by 4.5% (after 2.6% in 2018), mainly as a result of higher pension payments. Here, too, growth will weaken somewhat next year. In contrast, corporate and investment income should pick up significantly next year following a decline this year. Overall, disposable income of private households will see a strong increase, rising by 3.1% and 3.3% in 2019 and 2020, respectively. The increase in consumer prices will be moderate at 1.5% in 2019 and 1.8% in 2020. Overall, private households will still see a purchasing power increase of 1.5% (2019) and 1.6% (2020). With the savings rate virtually unchanged, private consumer spending is expected to grow strongly over the course of the forecast period and thus make a noticeable contribution to overall economic expansion.

Although capital investment will expand less dynamically than recently, the institutes do not expect a slump in investment activity, as observed in most previous downturns. One reason for this is that investment activity expanded only moderately in the previous upswing, so the surges in capacity expansion typical of boom phases were probably less pronounced this time. Residential construction continues to be a pillar of construction investment, partly because financing costs remain low. Ample order backlogs and robust price development indicate that the expansion of construction activity is being limited above all by capacity bottlenecks in the construction industry.

Fiscal policy will provide a major stimulus in 2019, amounting to 0.7% of GDP. This will primarily take the form of income tax relief and additional pension insurance benefits. Public sector investment will also continue to expand, albeit not as strongly as in 2018, when budgets for construction projects were increased by more than 10% in nominal terms. At 0.4%, the fiscal policy stimulus in 2020 will be much lower. The general government surplus will fall from last year’s 1.7% of GDP to 1.2% (2019) and 1.0% (2020). Calculated with the modified EU method and adjusting for cyclical and one-off effects, the surplus in relation to production potential will decline from 1.3% in 2018 to 1.1% (2019) and then to 0.8% (2020).

The economic slowdown raises the question of possible consequences for fiscal policy. So far, public debate has focused on balancing the federal budget – breaking even at what is known in Germany as the “black zero”. In addition, the debt brake anchored in the country’s constitution is again the subject of controversy. A clear distinction should be made between the two concepts: the debt brake relates to the structural deficit; the “black zero” relates to the nominal deficit. Politicians should let the automatic stabilisers do their job, rather than consciously saving for the sake of the “black zero”; after all, both the German debt brake and the European fiscal policy framework explicitly permit cyclical deficits.

While cyclically driven government surpluses will decline, structural surpluses will remain significant for the time being. However, in “fat” years of the past, politicians decided to extend pension benefits; as the legislation currently stands, these will eat into structural budget surpluses in the medium term. German economic policy is thus creating risks by placing a considerable burden on the long-term stability of the statutory pension insurance system inasmuch as the expansion of benefits cannot be financed from payments into the system. This raises expectations of tax increases that will adversely affect Germany as a location for investment. At the same time, expansions to these benefits reduce the room for manoeuvre elsewhere. Investments in research, education, and infrastructure are more urgent than ever in view of the increasingly fierce competition between countries to attract business. In addition, demographic change calls all the more for policymakers to take into account the impact of social policy measures on work incentives.

Major risks for the German economy have been coming from the international arena for some time now: trade conflicts driven by the US may escalate again in the near future, and there could be an unregulated withdrawal of the UK from the European Union. In both cases, political decisions would have a negative impact on international economic integration. The German economy would be particularly affected as the US and the UK are among its most important trading partners. In addition, current assessments of the economic situation in China – the biggest importer of German goods after the US and France – are especially uncertain.

International economic risks are affecting the automotive industry in particular. For example, threatened US tariff increases would have a considerable impact on German car exports, and both the British and the Chinese sales markets are of great importance for German manufacturers. The industry faces other risks as well: the sluggish recovery in production after the slump caused by the introduction of WLTP may indicate that the automotive industry is struggling with sales problems – and not just over the short term. Here, controversy surrounding the environmental friendliness of conventional vehicles may play a role. This could lead to a wait-and-see attitude on the part of customers and could also force changes to production processes – changes that will most likely not run smoothly. Because automotive manufacturing is so important to the German economy, these risks pose a threat not only to the industry, but to the economy as a whole. An upside risk for the forecast arises from the fact that the institutes may underestimate the extent of the recovery in the manufacturing sector, as the special factors make it difficult to diagnose the underlying economic trend. Should the drop in production be made up more quickly, GDP could temporarily expand at significantly higher rates than the institutes expect. Less dynamic economic development could result if production is hampered more than the institutes expect due to supply bottlenecks and a shortage of skilled workers. According to surveys, these production obstacles have diminished conspicuously since the middle of last year; however, the proportion of companies reporting them remains unusually high.