Economic activity in the world and in Germany is losing momentum

The international economy

At the end of the year 2018, many things point to a gentle end to the global economic upturn. Since the beginning of the year, companies have been less upbeat on average, and share prices have fallen worldwide. The main reasons for the increasingly skeptical views of companies and financial market participants for the year 2019 are the expiration of expansive impulses from the monetary and financial policy in the US and the continuation of trade conflicts. Though the US agreed with China on a three-month standstill agreement at the end of November, the dispute, similar to the one with the European Union, can soon escalate again. Overall, economic policy in the advanced economies will be less expansionary in 2019 than it was in 2018. However, the European Central Bank (ECB) is unlikely to raise its key interest rates to above 0% before the end of 2019, partly because of the continued low price pressure. Fiscal policy will be expansive in the Euro area in 2019, but only slightly so when abstracting from Italy. Due to trade conflicts and also because the expansion of production often reaches capacity limits, especially in the construction industry, global production will expand by 3.0% in 2019, more slowly than in previous years.

The German economy

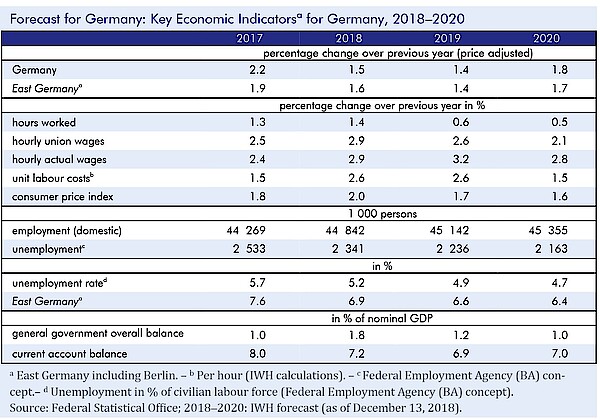

In the second half of 2018, the upturn in the German economy has stalled. In the third quarter, production dropped for the first time in three and a half years. The setback is mainly due to problems in the automotive industry: Many vehicle types were not available because they were not certified according to the new emission test method. However, production growth would probably have slowed even without these dampers. Export business has been weakening since the beginning of the year, as the international economy was unable to keep up with the strong momentum of 2017. Domestically, however, the upturn in Germany seems not to have slowed down over the course of the year. One main reason for this is that financing conditions continue to be favourable, and they will remain attractive in 2019 due to the expansionary monetary policy of the ECB. However, it is expected that the less benign external environment dampens exports and will soon affect companies’ investment and hiring decisions – initially in the manufacturing industry, later in the service sector. The shortage of skilled workers in construction, but also in other sectors, has an additional damping effect. All together, it is expected that production in 2019 will only increase at about the same rate as the production capacity. All in all, according to this forecast, gross domestic product in Germany will increase by 1.5% in 2018 and by 1.4% in 2019.

The factors that dampen the overall German economy apply to East Germany as well, since shortages of skilled labour are even more serious here than in the West. However, a significant expansion in disposable incomes is likely to cause East German households to expand their consumption significantly. We expect production in East Germany to expand by 1.6% in 2019 and the unemployment rate to fall from 6.9% in 2018 to 6.6% in 2019.

The risks to the German economy are essentially the same as those for the global economy. The uncertainties associated with Brexit and the conflict over the Italian budget are of particular importance to Germany, since it is a close trading partner of both economies. In addition, the introduction of high US tariffs on automobile imports would probably hit the German economy particularly hard because the motor industries are of great importance in Germany. There are other risks associated with the automotive sector: The decline in production might not solely have been due to certification problems, since diesel-powered vehicles, a product class that is particularly important for German suppliers, apparently have lost much of their appeal. More generally speaking, a structural change in the automotive industry expected by many experts could rather soon become reality and might weigh on the German economy in the coming years.

The extended version of this forecast (“Konjunktur in der Welt und in Deutschland verliert an Dynamik“) includes a box on the effects of introducing WLTP on motor vehicle production from a European perspective and a box on estimating the production potential in Germany.

Publication

Brautzsch, Hans-Ulrich; Claudio, João Carlos; Drygalla, Andrej; Exß, Franziska; Heinisch, Katja; Holtemöller, Oliver; Kämpfe, Martina; Lindner, Axel; Müller, Isabella; Schultz, Birgit; Staffa, Ruben; Wieschemeyer, Matthias; Zeddies, Götz: Konjunktur aktuell: Konjunktur in der Welt und in Deutschland verliert an Dynamik. Konjunktur aktuell, Jg. 6 (4), 2018. Halle (Saale) 2018.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Konjunktur aktuell: Konjunktur in der Welt und in Deutschland verliert an Dynamik

in: Konjunktur aktuell, 4, 2018

Abstract

Im zweiten Halbjahr 2018 ist der Aufschwung der deutschen Wirtschaft ins Stocken geraten. Dabei geht der leichte Rückgang des Bruttoinlandsprodukts im dritten Quartal vor allem auf Probleme der Automobilbranche zurück: Viele Fahrzeugtypen waren nicht lieferbar, weil die Zertifizierung nach dem neuen Abgas-Prüfverfahren fehlte. Allerdings schwächt sich das Auslandsgeschäft schon seit Beginn des Jahres ab, denn die internationale Konjunktur hat den hohen Schwung des Jahres 2017 nicht halten können, vor allem wegen der hohen politischen Unsicherheiten, welche die Handelskonflikte, der nahende Brexit und der Konflikt um den italienischen Staatshaushalt mit sich bringen. Binnenwirtschaftlich dürfte sich aber der Aufschwung in Deutschland im Lauf des Jahres kaum verlangsamt haben. Ein Hauptgrund dafür sind die weiter sehr günstigen Finanzierungsbedingungen. Sie werden aufgrund der expansiven Geldpolitik der EZB auch im Jahr 2019 günstig bleiben. Allerdings ist zu erwarten, dass das weniger freundliche außenwirtschaftliche Umfeld nicht nur die Exporte dämpft, sondern bald auch auf Investitionsentscheidungen und Personalpolitik der Unternehmen durchschlagen wird; zunächst wohl im Verarbeitenden Gewerbe, dann auch bei den Dienstleistern. Weiter bremsend wirkt zugleich der Fachkräftemangel am Bau, aber auch in anderen Branchen. Alles in allem ist damit zu rechnen, dass die Produktion im Jahr 2019 nur noch in etwa so stark zulegt wie die Produktionskapazitäten: Das Bruttoinlandsprodukt dürfte im Jahr 2018 um 1,5% und im Jahr 2019 um 1,4% steigen. Der gesamtstaatliche Haushaltsüberschuss beträgt im Jahr 2018 60 Mrd. Euro. Im Jahr 2019 verringert er sich auf 42 Mrd. Euro. Die ostdeutsche Wirtschaft dürfte in den Jahren 2018 und 2019 in etwa so schnell expandieren wie die gesamtdeutsche.