Germany stuck in stagnation ‒ private consumption remains below pre-pandemic levels

At the beginning of 2024, sentiment indicators show a slightly brightening outlook for the international economy. Global production momentum had still been declining until the end of 2023. This was due to high inflation, restrictive monetary policy, for Europe the Russian war against Ukraine, and for China the crisis of its housing sector. Against this backdrop, financial markets are remarkably optimistic, partly due to the anticipation of key interest rate cuts starting next summer. In addition, investors are expecting growth stimuli from innovations in the field of artificial intelligence. For the USA, the fact that the restrictive monetary policy has so far had surprisingly little dampening effect can give cause for optimism. In Europe, however, momentum is likely to remain fairly weak. Reasons for this include higher energy costs in the manufacturing sector and industrial policies in the USA and China that put foreign exporters at a disadvantage.

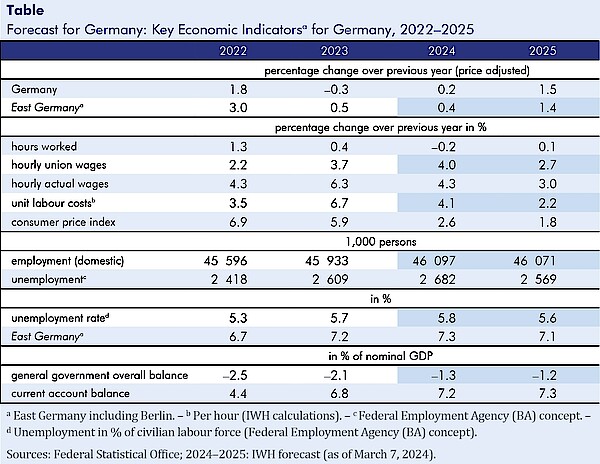

“Germany is experiencing prolonged stagnation,” says Oliver Holtemöller, head of the Macroeconomics Department and vice president at the IWH. At the end of 2023, private consumption and investment were lower than before the outbreak of the pandemic four years ago. There are several reasons for this. High inflation has depressed real incomes and households are holding back on consumer spending. Industrial production in energy-intensive sectors is declining significantly. However, general concerns about Germany's competitiveness as a business location are also depressing the propensity of households and companies to spend. What is supporting the economy is the fairly robust labour market. The recent rise in real wages is likely to continue in 2024 and the resulting increase in private consumption will stabilise corporate investment. However, construction investment will continue to suffer from high financing costs. “Economic stagnation will continue in the first half of the year, with the economy expected to pick up slightly thereafter,” says Holtemöller. The general government budget deficit is likely to decrease further due to the restrictive fiscal policy and the gradual economic recovery.

“One risk for the German economy relates to the question of how well today’s significant structural change can be managed,” the economist says. Parts of the manufacturing industry, such as energy-intensive producers or suppliers to the automotive industry, are shedding jobs. As there is a shortage of labour in the economy as a whole, it should in principle be possible to quickly re-employ the skilled workers who have been made redundant, some of whom are highly qualified. There are, however, often major obstacles to both regional and professional mobility that make reallocation in Germany difficult. Moreover, the currently widespread uncertainty could prevent companies from hiring labour in order to expand their business activities.

The extended version of this forecast contains three boxes (all in German):

Box 1: GRNN ‒ A new tool in the forecasting toolbox for nowcasting GDP

Box 2: On the estimation of potential output

Box 3: An analysis of forecast quality with help of the IWH Forecasting Dashboard

Publication:

Drygalla, Andrej; Exß, Franziska; Heinisch, Katja; Holtemöller, Oliver; Kämpfe, Martina; Kozyrev, Boris; Lindner, Axel; Mukherjee, Sukanya; Sardone, Alessandro; Schult, Christoph; Schultz, Birgit; Zeddies, Götz: Konjunktur aktuell: Deutschland in der Stagnation festgefahren – privater Konsum weiter unter dem Niveau von vor der Pandemie. IWH, Konjunktur aktuell, Jg. 12 (1), 2024. Halle (Saale) 2024.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-765 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Konjunktur aktuell: Deutschland in der Stagnation festgefahren – privater Konsum weiter unter dem Niveau von vor der Pandemie

in: Konjunktur aktuell, 1, 2024

Abstract

<p>Zu Beginn des Jahres 2024 zeigen Stimmungsindikatoren etwas aufgehellte Aussichten für die internationale Konjunktur. In Europa dürfte die Dynamik allerdings recht schwach bleiben. Deutschland befindet sich in einer lang anhaltenden Stagnation, die sich bis zum Sommer fortsetzen wird. Für die Zeit danach ist mit einem leichten Anziehen der Konjunktur zu rechnen. Das Bruttoinlandsprodukt dürfte im Jahr 2024 um lediglich 0,2% expandieren, für 2025 prognostiziert das IWH einen Zuwachs um 1,5%.</p>