Global economy under the spell of the coronavirus epidemic

Since the end of January 2020, the coronavirus epidemic has affected the global economy. Production and demand in China probably declined in the first quarter. Although economic life in China gradually returns to normal amid a significant decline in new cases, the number of confirmed cases steeply rises elsewhere. For many advanced economies, the economic consequences are likely to be similar to those for China. The significant interest rate cut by the US Federal Reserve at the beginning of March was unable to prevent severe price slumps on the stock and commodity markets. However, the current forecast assumes that the spread of the epidemic in advanced economies will be contained in the second half of the year as it is already the case in China. Under this assumption, the global economy is likely to remain weak in the first half of 2020, but will recover from summer onwards.

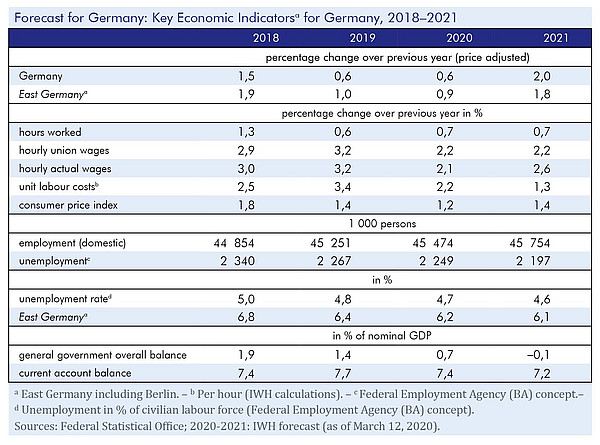

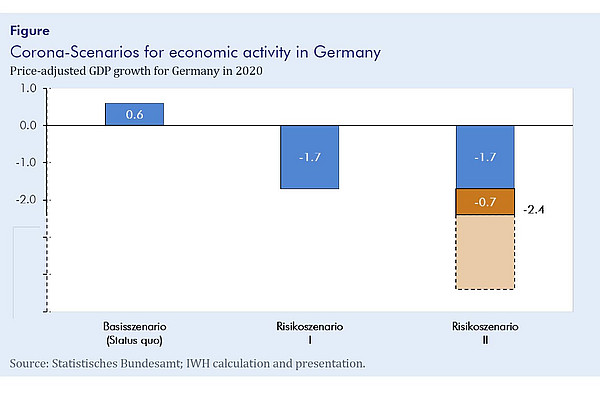

The epidemic hit the German economy at a time when a prolonged period of economic weakness seemed to come to end. World trade, however, is now expected to slump in the first half of 2020. In addition, the uncertainty associated with the epidemic should also dampen economic activity in Germany. Production is expected to decline slightly in the second quarter of 2020. Under the assumption that the epidemic in Germany and abroad tails off in the second half of the year, the economy should pick up quite strongly during next winter. According to this forecast, production is expected to grow by 0.6% in 2020 and in 2021 by 2.0%. Around one third of the increase is attributed to a higher number of working days. The temporary decline in production is unlikely to have a significant impact on employment, not least because recent employment growth has mainly taken place in sectors that are hardly or not at all affected by the current economic downturn. At 1.0%, the economy in Eastern Germany is expanding markedly faster than the overall German economy this year, mainly because consumer goods, for which demand is likely to remain fairly stable, are an important part of East German production. “A major risk for the German economy poses the potential restriction of the labour supply if many people get sick at the same time. Even in the case of mostly mild courses, this could temporarily lead to a significant decrease of labour input for specific quarters”, says Oliver Holtemöller, head of the Department Macroeconomics and vice president at the Halle Institute for Economic Research (IWH). He considers that measures to contain the spread of the disease and increasing uncertainty could then also dampen domestic demand even further.

Economic implications of the coronavirus crisis

Economic policy measures that stimulate aggregate demand are currently not appropriate. The necessary measures to contain the infections lead to short-term losses, which must be accepted in order to prevent even greater damage in the future. The top priority is to slow down the spread of the virus. Next policy actions should aim at preventing an excessive increase in corporate insolvencies. A multi-stage system is suitable for this. Short-time work regulations have already been extended. The first partner for firms in the event of liquidity bottlenecks are banks. These must therefore remain operational and should be supported by liquidity measures where necessary. If the risks in individual firms are so high that banks refuse to lend, then state guarantees, while maintaining a certain level of risk for the banks themselves, are the next step. Deferments of government claims (such as taxes and social security contributions) may be an additional measure, although they might not be targeted. If all this is not sufficient to avert major damage, financial transfers to individual firms may be considered. Although preparations should now be made for this and a public signal should be given that this instrument would be used if necessary, it is too early to take concrete decisions on direct financial transfers to firms. This requires a better empirical basis. Measures to stimulate aggregate demand would only make sense if private demand does not catch up after new infections have slowed down.

The full version of the forecast contains three boxes:

Box 1: Assumptions and forecasts regarding the general conditions

Box 2: Estimation of potential output

Box 3: The Corona epidemic as a risk for the German economy

Publication

Brautzsch, Hans-Ulrich; Claudio, Joao Carlos; Drygalla, Andrej; Exß, Franziska; Heinisch, Katja; Holtemöller, Oliver; Kämpfe, Martina; Lindner, Axel; Müller, Isabella; Schultz, Birgit; Staffa, Ruben; Wieschemeyer, Matthias; Zeddies, Götz: Wirtschaft im Bann der Corona-Epidemie, in: IWH, Konjunktur aktuell, Jg. 8 (1), 2020. Halle (Saale) 2020.

Online appendix of the publication

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Konjunktur aktuell: Wirtschaft im Bann der Corona-Epidemie

in: Konjunktur aktuell, 1, 2020

Abstract

Seit Ende Januar 2020 steht die Weltwirtschaft unter dem Eindruck der Corona-Epidemie. Nach ihrem Ausbruch in China sind dort im ersten Quartal Produktion und Nachfrage eingebrochen. Mit dem deutlichen Rückgang der Neuerkrankungen kommt das Wirtschaftsleben in China gegenwärtig nach und nach wieder in Gang. Zugleich steigt aber andernorts die Zahl der Krankheitsfälle, und für viele fortgeschrittene Volkswirtschaften ist mit ähnlichen wirtschaftlichen Folgen wie in China zu rechnen. Die vorliegende Prognose unterstellt, dass sich die Ausbreitung der Epidemie insgesamt wie in China eindämmen lässt. Unter dieser Annahme dürfte die Weltkonjunktur im ersten Halbjahr 2020 sehr schwach bleiben, sich aber ab dem Sommer langsam erholen.