Revival in service sectors, but industrial activity remains weak for the time being

In summer 2023, sentiment indicators point to a global upswing in the service sectors, but they are still weak for manufacturing. In Europe, energy intensive producers as well as private households suffer from high energy prices. High inflation and rising key interest rates are dampening economic activity in most regions of the world. Inflation rates, however, are gradually declining, and key interest rates will rise only a bit more. Still, for the second half of 2023, US production is expected to be roughly stagnant. In the euro area, with wage momentum rising, real wages should stop falling from the second half of the year onwards, and production will start expanding. In China, the recovery continues, albeit with moderate momentum. Overall, the dynamics of the global economy will remain subdued in 2023.

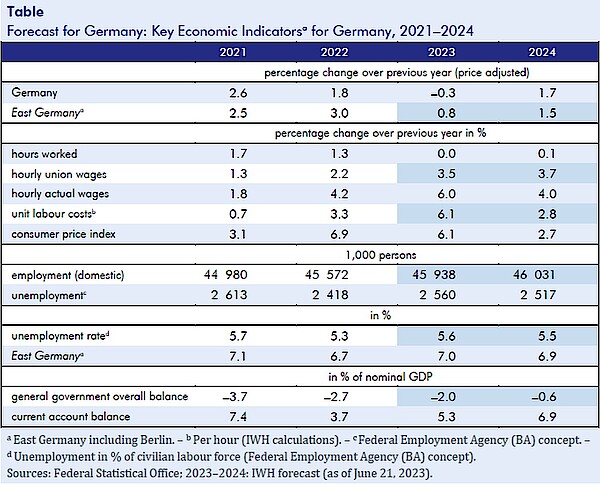

The German economy was in recession during the winter, since private consumption shrank due to a decline in real disposable income caused by high inflation. In addition, government consumption fell sharply in the first quarter. Unlike gross domestic product (GDP), however, gross value added increased at the beginning of the year. The discrepancy can partly be explained by the weakness of private consumption, which dampens GDP more than value added via lower sales taxes. In the coming quarters, consumption should increase again. Tight labour markets give employees job security. While so far, labour shortages and high inflation have had little impact on collectively agreed wages, effective earnings are rising more strongly. In addition, many collective agreements are more favourable for workers than wage increases suggest because these are currently exempt from social security and wage taxes. Since at the same time price dynamics are slowly declining, real labour incomes will soon be increasing somewhat. Hardly any boost will come from exports, since the global economy remains sluggish, and some German exporters have lost competitiveness. Higher financing costs will dampen gross fixed capital formation, especially in buildings. Overall, production in Germany will increase moderately in the further course of the year. “For 2023 as a whole, production is 0.3% lower than last year,” says Oliver Holtemöller, head of the Macroeconomics Department and vice president at the IWH. “For 2024, we forecast growth to be 1.7%.” Inflation is expected to be 6.1% for 2023 and 2.7% for 2024.

A risk factor for the German economy is the uncertainty about potential growth. According to the current forecast, production will increase at rather healthy rates from the end of 2023, so that the economy will approach normal capacity utilisation at the end of 2024. However, labour shortages are widespread and capital is likely to have become obsolete in important manufacturing sectors, such as the chemical industry. It is therefore not certain that there is sufficient capacity for the expected expansion.

The extended version of the forecast contains three boxes

(all in German):

Box 1: General conditions for the forecast

Box 2: On the estimate of potential output

Box 3: The IWH's PRIMA indicator suggests that the German economy might remain weak in 2024

Publication: Drygalla, Andrej; Exß, Franziska; Heinisch, Katja; Holtemöller, Oliver; Kämpfe, Martina; Kozyrev, Boris; Lindner, Axel; Mukherjee, Sukanya; Sardone, Alessandro; Schult, Christoph; Schultz, Birgit; Zeddies, Götz: Konjunktur aktuell: Belebung in Dienstleistungsbranchen, aber zunächst weiter schwache Industriekonjunktur. IWH, Konjunktur aktuell, Jg. 11 (2), 2023. Halle (Saale) 2023.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Konjunktur aktuell: Belebung in Dienstleistungsbranchen, aber zunächst weiter schwache Industriekonjunktur

in: Konjunktur aktuell, 2, 2023

Abstract

Im Sommer 2023 deuten Stimmungsindikatoren auf einen weltweiten Aufschwung in den Dienstleistungsbranchen, die Konjunktur im Verarbeitenden Gewerbe bleibt aber schwach. Hohe Inflation und gestiegene Leitzinsen dämpfen die Konjunktur in den meisten Weltregionen. In Europa belasten auch im langjährigen Vergleich hohe Energiepreise. Insgesamt bleibt die Dynamik der Weltwirtschaft im Jahr 2023 verhalten. Die deutsche Wirtschaft wird in mäßigem Tempo expandieren, denn mit sinkender Inflation und erhöhter Lohndynamik wird der private Konsum wieder zulegen. Das Bruttoinlandsprodukt dürfte 2023 um 0,3% zurückgehen, für das kommende Jahr ist ein Zuwachs von 1,7% prognostiziert. Für 2023 ist mit einer Inflationsrate von 6,1% und für 2024 mit 2,7% zu rechnen.