Economists – and the others

Economists have long been thought to make decisions differently to non-economists. And this assumption is no wonder: experiments in the past have shown that economists actually behave more like homo oeconomicus than non-economists do, i.e. they concentrate more strongly on maximising their own utility. In the case of public services, such as street lighting, the interest of the individual – to benefit, but contribute as little as possible – is often in contrast with the optimum for society, i.e. to have the street fully lit. This is why such services are usually publicly financed. Under which conditions individuals, however, are also prepared to help pay for public services is explored in these kinds of experiments. The focus lies on two factors: the individual’s own character, but also his or her expectations regarding the willingness to cooperate of the other members of the community. For whether or not a person will pay for a public good also depends on whether other people are willing to do so too. Such experimental studies have in fact shown that economists tend to share public goods but contribute less to them than other groups of people.

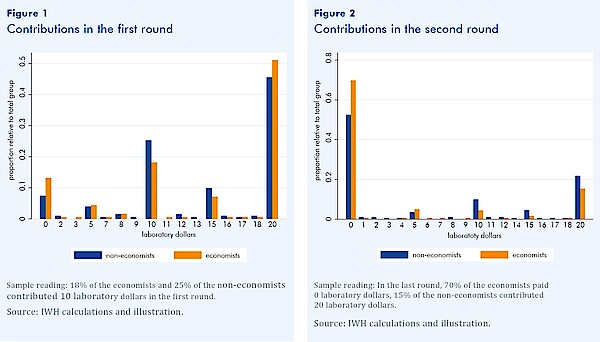

In order to now examine the differences between economists and non-economists more closely, in a laboratory experiment Bershadskyy tested the behaviour of economists at different points in time: “At the beginning of the experiment, a higher percentage of the economists do in fact behave like free-riders. But there are more economists who make optimal social contributions,” said Bershadskyy. “Furthermore, on average they pay optimal social contributions for one round longer.” On the whole, however, their cooperation steadily decreases over time.

The biggest differences then emerge towards the end of the experiment, during what is known as the endgame. During this phase, it is far more tempting to contribute nothing towards the public goods because a refusal to cooperate will no longer have any consequences. Economists then make considerably lower contributions than non-economists.

According to Bershadskyy, there can be several reasons for the different behaviour exhibited by the economists: “A selection effect may be possible, for example. This would mean that people who are naturally more conscious of incentives tend to study economics more often than other people. An educational effect is also conceivable: in the course of their studies, economists deal more intensively with incentive structures, which sharpen their sensitivity to them.”

The differences between economists and non-economists can thus influence the results of behavioural economics: “Our results show that caution must always be exercised when drawing conclusions for real life based on laboratory experiments, because often a considerable number of the test persons come from economics and business courses. As we have shown, this fact can distort the results,” explained the economist.

During the survey, 84 students took part in an experiment involving public goods and lasting for several rounds. In the course of the experiment, the test subjects were able to win laboratory dollars, which were converted into real euros and paid out to them according to their game results at the end of the experiment. The experiment consisted of three parts. In the first part, the financing of a public good was simulated, whereby the participants were able to invest their own personal laboratory money. The test persons had to decide in groups whether they wanted to keep their money budget received at the beginning of the game or whether they wanted to invest it in the public good. Any personal money kept remained unchanged in value. However, all of the money invested in the public good was doubled and paid out to all the members of the community in equal parts at the end. Before the beginning of the second part, the groups were reshuffled. In the new groups, the test subjects were able to communicate with each other briefly; this opportunity for personal exchange strongly increased the contributions to the public good. Following the communication phase, in their groups the test subjects repeated the same mechanism of voluntary contributions over ten rounds. After that, the groups were reshuffled again. In the third part of the experiment, the participants had the option of financing as a group the efficient communication platform they had become acquainted with in the second part. The individuals were informed about the cost of the platform and were to contribute to it independently of each other. If the contributions of a group turned out higher than the stated cost of the platform, they were also allowed to communicate in the third round prior to the first contribution period. Otherwise the experimental rounds had to be repeated, with no communication allowed.

Whom to contact

For Researchers

Economist

If you have any further questions please contact me.

+49 345 7753-863 Request per E-MailFor Journalists

Head of Public Relations

If you have any further questions please contact me.

+49 345 7753-765 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Die Mär vom egoistischen Ökonomen – Wie Ökonomen auf Anreize reagieren

in: Wirtschaft im Wandel, 1, 2018

Abstract

Menschen, die über ökonomische Bildung verfügen, reagieren stärker auf wirtschaftliche Anreize. Entgegen der verbreiteten Annahme handeln Ökonomen jedoch nicht egoistischer als Nicht-Ökonomen, wenn es darum geht, gemeinsam ein öffentliches Gut zu finanzieren. Mit Hilfe eines Experiments, in dem die Teilnehmer echtes Geld gewinnen konnten, wird gezeigt, dass Ökonomen sich stärker an den vorliegenden Anreizstrukturen orientieren. Auf der einen Seite tragen Ökonomen am Anfang leicht höher zu dem öffentlichen Gut bei und fangen signifikant später an, von der sozial optimalen Strategie abzuweichen. Auf der anderen Seite leisten Ökonomen zum Ende des Experiments, wenn Trittbrettfahrerverhalten weniger Konsequenzen hat, deutlich geringere Beiträge als Nicht-Ökonomen. Im zweiten Teil des Experiments wird den Teilnehmenden die Möglichkeit gegeben, in eine Erleichterung der kooperativen Finanzierung des öffentlichen Guts zu investieren, wobei zwischen einem investitionsfreundlichen (Geld-zurück-Garantie) und einem weniger investitionsfreundlichen Szenario (keine Garantie) unterschieden wird. Das Experiment zeigt, dass die Probanden mit ökonomischer Ausbildung auf diesen kleinen Unterschied in den Anreizstrukturen stärker reagieren.

Endogenous Institution Formation in Public Good Games: The Effect of Economic Education

in: IWH Discussion Papers, 29, 2017

Abstract

In a public good experiment, the paper analyses to which extent individuals with economic education behave differently in a second-order dilemma. Second-order dilemmas may arise, when individuals endogenously build up costly institutions that help to overcome a public good problem (first-order dilemma). The specific institution used in the experiment is a communication platform allowing for group communication before the first-order public good game takes place. The experimental results confirm the finding of the literature that economists tend to free ride more intensively in public good games than non-economists. The difference is the strongest in the end-game phase, yielding in the conclusion that the magnitude of the end-game effect depends on the share of economists in the pool of participants. When it comes to the building-up of institutions, the individual efficiency gain of the institution and its inherent cost function constitute the driving forces for the contribution behaviour. Providing an investment friendly environment yields in economists contributing more to the institution than non-economists. Therefore, we make clear that first-order results of a simple public good game cannot be simply applied for second-order incentive problems.