IWH Bankruptcy Update: Upward Trend in Bankruptcies Stopped; Reintroduction of Filing Requirement Unlikely to Generate Bankruptcy Wave

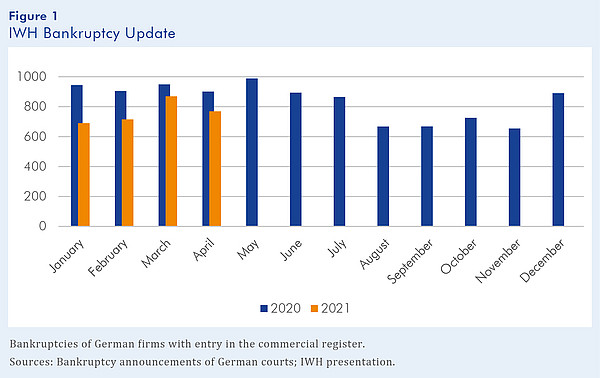

Following a sharp increase in March, the number of corporate bankruptcies fell in April. According to the IWH Bankruptcy Update, 769 firms reported bankruptcy last month. This is equivalent to a month-over-month decline of more than 10%. Compared to the April 2020 figure, the number of bankruptcies was also significantly lower (see figure 1).

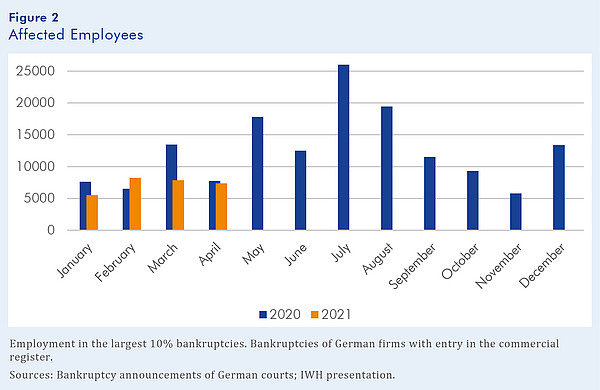

The largest 10% of firms (in terms of headcount) declaring bankruptcy in April employed a total of 7,400 people, according to IWH analysis. The number of jobs affected by bankruptcy last month was thus similar to that of prior months. By contrast, the number of jobs impacted in the summer months of 2020 was much higher

(see figure 2).

The obligation to file for bankruptcy was fully reinstated on

1 May 2021. This change has fueled fears of a looming wave in corporate bankruptcies. However, the IWH believes that such fears are unfounded. “The return of the filing requirement is unlikely to trigger a wave of corporate bankruptcies with massive job losses,” explains Steffen Müller, the head of Department Structural Change and Productivity and the director of Bankruptcy Research at IWH. To support this assessment, Müller notes that the May 1 change primarily applies to the subset of firms eligible to receive federal aid in November and December of 2020. All other firms have been required to file since January 1. Moreover, the filing suspension to May 1 did not apply to firms that would go bankrupt despite government assistance. Even if the return to mandatory filing were to lead to slightly higher bankruptcy figures, due to the structure of the economy, smaller firms would be primarily affected, and the overall economic impacts would be very limited, Müller concludes.

Looking beyond corporations – which are generally larger and thus more significant to the macroeconomy –, in February there was a sharp increase in the number of bankruptcies among microbusinesses and the self-employed. This increase is likely attributable to a legal change that took effect on 1 January 2021, which has made it easier for private individuals and the self-employed to discharge residual debt. This legal change reduces the negative consequences of declaring bankruptcy – and has nothing to do with the reinstatement of the bankruptcy filing obligation in May. Historically, only about 10% of job losses due to bankruptcy are attributable to microbusinesses, because of their small size. However, the exploding bankruptcy rates among microbusinesses means that the total number of jobs affected could also reach significant levels. Preliminary analyses conducted by IWH indicate that this rise in bankruptcies among microbusinesses did not continue in April. The macro significance of these bankruptcies thus remains limited.

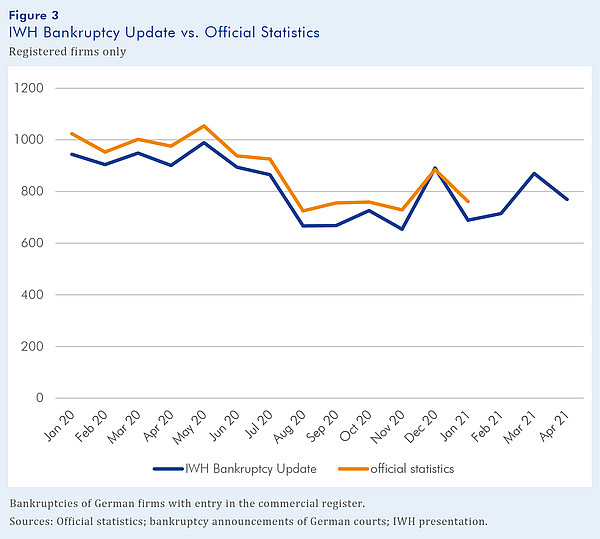

The IWH Bankruptcy Update is a flash indicator, delivering fast, reliable information on insolvencies of firms with entry in the commercial register in Germany two months ahead of the comprehensive official statistics. It is based on public bankruptcy announcements of German courts combined with balance sheet information of the concerned firms. Deviations from official statistics are small (see figure 3). The IWH Bankruptcy Research Unit is among Germany’s leading investigators of the causes and consequences of corporate bankruptcy.

For more on the IWH Bankruptcy Research Unit and the methodology underlying it, please visit https://www.iwh-halle.de/en/research/data-and-analysis/iwh-bank ruptcy-research/.

Whom to contact

For Researchers

Department Head

If you have any further questions please contact me.

+49 345 7753-708 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.