Joint Economic Forecast Spring 2018: Germany’s Economic Experts Raise Forecast Slightly

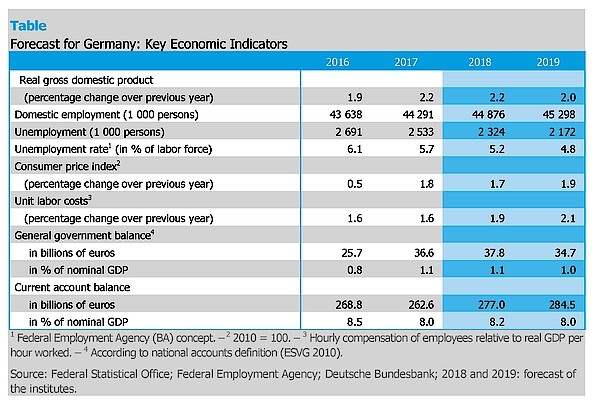

Despite tax cuts and higher public spending, the fiscal surplus remains almost unchanged at 36.6 billion euros in 2017, 37.8 billion euros in 2018 and 34.7 billion euros in 2019 thanks to the German economy’s strong performance and as a result growing tax revenue caused by bracket creep. The number of persons in employment grew from 44.3 million in 2017 to 44.9 million in 2018 and will increase to 45.3 million euros in the year ahead. At the same time, unemployment will drop from 2.5 million to 2.3 million persons this year and 2.2 million in 2019. This will bring the unemployment rate down from 5.7 percent last year to 5.2 percent in 2018, followed by 4.8 percent in 2019.Consumer price inflation will rise to 1.9 percent by 2019. Germany’s current account surplus (goods, services and current transfers) is expected to increase slightly from 262.6 billion euros in 2017 to 277.0 billion euros this year and 284.5 billion euros in 2019. These figures respectively represent 8.0 percent, 8.2 percent and 8.0 percent of Germany’s annual gross domestic product.

The Joint Economic Forecast is prepared by the DIW (Berlin), the ifo Institute (Munich), the IfW (Kiel), the IWH (Halle) and the RWI (Essen).

Summary: German Economy Booming – But Air is Getting Thinner

The German economy continues to boom, but the air is getting thinner. Unused economic capacities are gradually shrinking, leading to a slight loss of economic impetus. The pace of economic expansion nevertheless remains brisk: the upturn in the world economy will continue to stimulate exports; and the domestic economy is also expected to remain buoyant thanks to the exceptionally favourable situation in the labour market. The fiscal measures outlined by Germany’s new government in its coalition agreement can be expected to stimulate demand. Annual average economic output can be expected to rise by 2.2 percent this year and by 2.0 percent in 2019. This represents a 0.2 percentage point increase in the institutes’ assessment of growth in gross domestic product versus their autumn 2017 forecast. Employment will continue to see clear growth, but will be weakened by labour market shortages. At the same time, gross wages can be expected to increase markedly. The inflation rate will also rise gradually from 1.7 percent this year to 1.9 percent in 2019.

The world economy continues to enjoy an economic upturn in spring 2018. In the major economies the rate of production capacity utilisation is still rising. Expansion rates, however, have exceeded their peak. On the one hand, capacity limits appear to be taking effect in a growing number of branches and countries, with the level of employment now very high in many places. On the other hand sentiment among companies has weakened markedly recently, probably partly as a reaction to growing uncertainty over economic policy in the USA.

Inflation is very low nearly everywhere. However, in view of the sharp drop in unemployment, upward pressure on wages will gradually increase in many countries. Emerging signs of a labour supply shortage on the one hand, as well as higher demand for consumer goods on the other, will gradually lead to an upsurge in prices at the consumer level both this year and in 2019.

Fiscal policy can be expected to provide the economy with additional stimuli over the forecasting period. In the USA in particular fiscal policy is very expansive. US tax reforms offer significant investment incentives. The corporate tax rate was reduced significantly and depreciation allowances on investments were made easier to take advantage of. The income tax burden was also reduced. In the euro area fiscal policy remains slightly expansive overall, not least thanks to Germany in the year ahead. In Japan fiscal policy measures were adopted once again, this time with the goal of boosting investments in human capital. Their fiscal impact, however, will be low in this case. Towards the end of the forecasting period fiscal policy in Japan will have a negative effect due to the value added tax increase announced for October 2019.

In view of rising capacity utilisation and gradually growing pressure on prices, monetary policy will slowly become less expansive. A tightening of monetary policy can already be seen in the USA, und interest rates will probably be raised slightly more quickly than forecast last autumn in view of the strong fiscal stimuli. Although the European Central Bank will terminate its net purchase of bonds this year, it is not expected to raise its base rates until the end of next year. The Bank of Japan will continue to implement an expansive policy throughout the entire forecasting period. This will further exacerbate differences between the monetary policy orientation of advanced economies.

World production will expand by 3.4 percent this year, resulting in growth on a similar scale to last year. Compared to the Joint Economic Forecast of Autumn 2017, the institutes have raised their forecast for 2018 by 0.3 percentage points. Tax cuts in the USA will stimulate economic activity there, which may have a knock-on effect on other countries. The dynamic in the world economy, however, will gradually flatten off over the forecasting period. This will partly be due to a harsher trade policy climate, which will burden global investments. On the one hand, it will be harder to expand production at the pace seen to date in view of low unemployment and high capacity utilisation in many countries. In the year ahead the pace of growth in the world economy will slow down, even if the world production growth rates of 3.1 percent will be far higher than the average of recent years. Compared to the Joint Economic Forecast of Autumn 2017, the institutes have upwardly revised their forecast for 2019 by 0.2 percentage points.

In the euro area economic upward forces continue to prevail. In the quarters ahead production will continue to rise more strongly than production potential, widening the production gap even further. Capacity utilisation is already very high. According to surveys, a lack of qualified staff in a growing number of countries means that vacant positions cannot be filled. Growing capacity bottlenecks are one reason why the economy will gradually lose impetus over the forecasting period. Growth in gross domestic product can be expected to slow to 1.9 percent in 2019, after increasing as strongly this year as in 2017, i.e. at a rate of 2.3 percent. Rising capacity utilisation will gradually increase upward pressure on prices. Consumer prices can be expected to increase by 1.5 percent in 2018 and by 1.7 percent in 2019.

The USA’s announcement of its plans to increase tariffs on steel and aluminium at the beginning of the year represents another step towards greater protectionism, since it was followed by additional protectionist measures and counter-measures. Although the tariffs were not actually implemented for key supplier countries, they remain a threat. Any further escalation of the trade conflict will restrict international trade in goods and significantly damage world economic growth in the mid-term. However, the constraining effects on trade and production will not just kick in once new trade restrictions are implemented. The mere discussion of such measures can increase uncertainty over a country’s future trade policy and weaken economic sentiment. Although the institutes deem it unlikely that current trade policy conflicts will dampen the strong economic momentum to the extent that they will halt the upturn in the world economy, the conflicts represent a downwards risk for the forecast, especially if they escalate.

If the trade conflict were to be rapidly resolved, however, current uncertainties would disappear and the global economic dynamic may be far stronger than assumed in this forecast. In those emerging countries where capacity under-utilisation has remained high in recent years due to recession, there is significant catch-up potential. The euro area, which has proven surprising in terms of the strength of its overall economic growth, could act as a role model in this respect.

The German economy is booming in spring 2018. Capacity utilisation is high and has been rising recently. After a dip, the pace of growth is expected to pick up at the beginning of next year. This means that the boom can be expected to continue in both 2018 and 2019, although it will run out of steam year as unused economic capacities gradually start to shrink. The pace of growth will nevertheless remain high: the upturn in the world economy will only slow down gradually and will continue to stimulate exports. Germany’s domestic economy will remain buoyant thanks to exceptionally favourable conditions in the labour market. Germany’s new government can also be expected to stimulate demand through the extension of expenditure and tax cuts outlined in the coalition agreement.

The German economy temporarily lost impetus in the first quarter of 2018. This was reflected in the sharp decline in production in manufacturing in February, as well as subdued exports. However, temporary effects, including a comparatively high number of work days lost due to illness, an exceptionally high number of strike days and an above-average number of public holidays, may have helped to weaken the economic dynamic. Manufacturers’ most recent assessments of production, however, indicate that the downturn will be offset in March. Figures on vehicle production also point in this direction.

A stronger dynamic is expected in the future than at the beginning of the year. Order backlogs in manufacturing are high and current business situation indicators also signal strong growth in the second quarter, despite slightly weaker sentiment at the moment. As for the second half-year, business expectations point to a slight slowdown in the pace of growth. Uncertainty over the international economic climate, particularly in terms of trade policy, probably also helped to dampen expectations.

Annual average economic output is expected to increase by 2.2 percent this year. The institutes have thus raised their assessment of growth in gross domestic product for this year by 0.2 percentage points compared to their autumn 2017 forecast. In the year ahead the German economy – boosted by the fiscal policy measures set out in the coalition agreement – will grow by 2.0 percent, which is also slightly stronger than forecast by the institutes in autumn.

In view of continued strong growth in the German economy employment will also continue to rise significantly. However, given the lack of suitably staff in many segments of the labour market and the fact that companies are struggling to fill vacant positions, the rise in employment will lose impetus. The number of persons in employment is expected to increase by 585,000 this year, while approximately 420,000 new jobs will be created in 2019. The unemployment rate will drop to 5.2 percent in 2018 and to 4.8 percent in 2019. Moreover, the vast majority of the increase in employment can be attributed to the growing labour market participation of women and older people, as well as immigrants.

As a result of growing labour shortages, clear increases are expected in gross wages. A per capita increase of around three percent in effective earnings is expected for both years of the forecasting period. Inflation, however, will also increase gradually from 1.7 percent this year to 1.9 percent in the year ahead. Households will nevertheless enjoy a significant increase in purchasing power, especially since the measures set out in the coalition agreement will provide clear stimuli. The return to the equal financing of statutory health insurance at the turn of the year 2018/2019 will particularly benefit employees, as this will involve an increase in net wages and salaries of around six billion euros in the short term at least. However, the planned reduction in unemployment insurance contributions, as well as the extension of statutory pension benefits will also have an impact. Overall, this will add up to a clear revenue increase in the year ahead. All in all private consumption can be expected to grow strongly over the forecasting period after a dip in the second half of 2017.

Since external demand is expected to rise significantly over the forecasting period, exports will continue to provide clear stimuli for overall economic production. Since production capacity utilisation rates are now high in many countries, the strong global economy will stimulate worldwide demand for equipment goods, which particularly stands to benefit Germany‘s export sector. Although imports will also rise markedly in the course of dynamic economic developments in Germany, the current account balance will remain high compared to gross domestic product at 8.2 percent this year and 8.0 percent in 2019.

Domestic investment activity is also expected to remain very strong, with high capacity utilisation in Germany and companies investing more in expansion. Although interest rates will rise gradually, financing conditions will remain favourable. This will boost investment in buildings and public construction will also remain buoyant – partly thanks to the coalition agreement. The construction sector, however, is now reaching its capacity limits. This can be seen in strong upwards pressure on prices, which will continue over the forecasting period. All in all, construction activity will remain lively.

Despite the more expansionary fiscal policy course outlined in the coalition agreement, the government’s financial situation will remain favourable in both years. Government revenues are increasing despite welfare contribution cuts in contributions to the social security system, as revenues from contributions, income tax and excise taxes are benefiting from favourable labour market developments and high private spending. On the expenditure side, the extension of statutory pension benefits and health insurance benefits, as well as the increase in child allowance are worth noting. A significant surplus nevertheless remains in the public budget of around 1 percent compared to gross domestic product in both 2018 and 2019. However, in structural terms, or if adjusted for business cycle and one-off effects, the surplus will fall from 0.5 percent this year to 0.4 percent in 2019. Here the effects related to expansionary fiscal policy will already become clear and will become even stronger later on over the course of the legislative period.

In addition to the escalating global trade conflict mentioned in the international section, risks inherent in the forecast largely stem from uncertainty in terms of the timeline for and volume of the additional expenditure and tax cuts outlined in the coalition agreement. If the government’s actual policy differs significantly from the assumptions made in this forecast regarding the distribution of expenditure over the legislative period, this may influence the economy in both directions. Another assumption made in the forecast is that there is sufficient total production capacity still available for the upturn to continue. This is supported by the fact that the capacity utilisation of the German economy is still below its previous peaks. If capacity limits turn out to be binding earlier, the next downturn could already take place in the forecasting period. Lastly, several financial market indicators suggest that production growth rates could fall far more significantly than forecast here. The prices of German stock market shares have fallen by around 10 percent since the beginning of the year and uncertainty, as expressed by share price volatility, has risen. In the past these indicators have shown a certain forecasting power for production. Overall, however, these signals are not strong enough to make a greater cooldown seem likely for the German economy.

The new German federal government is facing a series of economic policy challenges. The current changes in both US trade and tax policy have international implications that will also affect Germany. International cooperation is required in both areas to increase global welfare. The international exchange of goods will lead to more prosperity gains the less it is restricted by trade constraints, and the stronger it is conducted multilaterally on the basis of market economy principles that are accepted by as many countries as possible. In corporate taxation national governments face internationally operating companies. Uncoordinated international taxation policy makes it is easier for such companies to take advantage of regulatory arbitrage and harder for nation states to tax them appropriately. In both trade policy and corporate taxation the institutes therefore recommend an internationally coordinated approach.

Economic policy also has to create the framework conditions for the efficient use of labour and capital at a national level in order to increase production potential through innovation and progress in productivity in the long term. This involves increasing the number of persons in employment by improving the compatibility of career and family life, integrating the long-term unemployed into the workforce, improving incentives to work by lowering the tax burden, as well as encouraging more older people to seek employment. These long-term challenges were partly addressed in the coalition agreement by the CDU, CSU and SPD.

The new German federal government’s expansionary fiscal policy plans will stimulate economic activity at a time of high capacity utilisation in the German economy and at which it is producing above its potential anyway, according to the statistics. Although financial policy should not be oriented towards short-term economic fluctuations - such fine-tuning is virtually impossible – it should take into account the implications for overall economic stability and the sustainability of public finances. Fiscal policy based on the government’s short-term financial position should be avoided. The extension of statutory pension benefits and commitments outlined in the coalition agreement runs counter to the idea of sustainability.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Germany’s Economic Experts Raise Forecast Slightly: Joint Economic Forecast Spring 2018

in: Externe Monographien, 2018

Abstract

Die Boomphase der deutschen Wirtschaft setzt sich fort. Allerdings wird die Luft dünner: Die noch verfügbaren gesamtwirtschaftlichen Kapazitäten werden allmählich knapper, sodass die Konjunktur etwas an Schwung verliert. Dennoch bleibt das Tempo hoch: Der Aufschwung der Weltwirtschaft wird die Exporte weiter anregen; auch die Binnenwirtschaft dürfte bei außerordentlich günstiger Lage auf dem Arbeitsmarkt schwungvoll bleiben. Zusätzlich dürfte die neue Bundesregierung durch die im Koalitionsvertrag vereinbarten fiskalischen Maßnahmen die Nachfrage stimulieren. Im Jahresdurchschnitt dürfte die Wirtschaftsleistung um 2,2 Prozent in diesem und um 2,0 Prozent im kommenden Jahr expandieren. Damit heben die Institute ihre Einschätzung für den Zuwachs des Bruttoinlandsprodukts in beiden Jahren um jeweils 0,2 Prozentpunkte gegenüber ihrer Herbstdiagnose 2017 an. Die Beschäftigung dürfte weiter spürbar steigen, aber aufgrund von Knappheit auf dem Arbeitsmarkt schwächt sich der Beschäftigungsaufbau ab. Zugleich dürften die Bruttolöhne recht spürbar zulegen. Auch die Inflationsrate zieht allmählich an, von 1,7 Prozent in diesem auf 1,9 Prozent im kommenden Jahr.