Recovery Loses Momentum ‒ Economy and Politics Still Shaped by the Pandemic

The downgrade of the forecast follows a more pessimistic assessment of the recovery process. "Although a substantial part of the drop in output experienced in spring has already been recovered, the remaining catch-up process is the more difficult part of the return to normality," said Stefan Kooths, head of forecasting at the Kiel Institute.

The recovery is being held back by those sectors that are particularly dependent on social contacts, such as restaurants and tourism, the event business and air traffic. "Activity in this part of the German economy will remain depressed for some time to come and will catch up with the rest of the economy only once measures to control the pandemic have largely been dropped, which we do not expect before next summer," said Kooths.

In addition, investment is slow to recover because many companies have seen their equity positions deteriorate as a result of the crisis. The recovery is being driven primarily by exports, which had contracted particularly sharply in the course of the crisis.

The precrisis level of output will not be reached until the end of 2021 with GDP then being still 2.5% below the level that would have prevailed without the pandemic. Normal capacity utilisation is expected to be reached only by the end of 2022. Kooths: "The consequences of the crisis are by no means over once the slump has been made up for. Production capacities are expected to be about one percent lower than precrisis estimates over the medium term, although the longer-term damage of the crisis is particularly hard to assess, as is the impact of policy responses.”

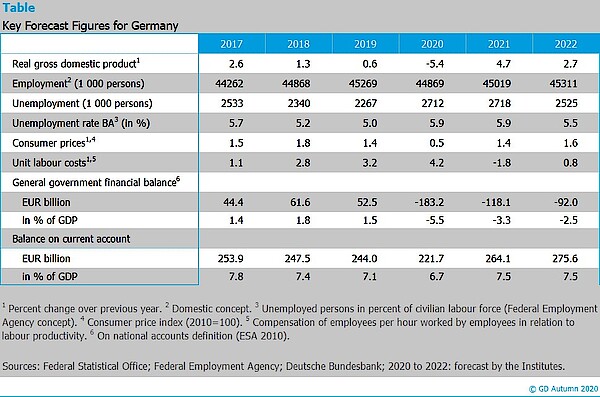

The corona crisis has also had a clear impact on the labour market. Despite massively falling back on short-time working schemes, an estimated 820,000 jobs were lost by mid-year. Since then, the number of people in employment has risen again slightly, but the precrisis level will not be reached until mid-2022. The unemployment rate is expected to rise to 5.9% this year and next year, and to fall slightly to 5.5% in 2022.

The economic stimulus packages, in conjunction with the automatic stabilisers, have helped to keep private disposable incomes relatively stable, even in the acute phase of the crisis. In return, the general government will incur a record high budget deficit of 183 billion euros this year. In 2021 and 2022, deficits will remain substantial at 118 billion euros and 92 billion euros, respectively.

The most important risk to the forecast stems from the still uncertain course of the pandemic. The institutes assume that starting in spring next year, disease control measures can be rolled back to such an extent that they no longer have a significant impact on economic activity by autumn. The unclear extent of corporate insolvencies in Germany and abroad as a result of the crisis also contributes to forecast uncertainty. In addition, various trade conflicts remain a source of concern. A positive risk to the outlook is the sharp rise in private savings which, if released more quickly than assumed in the forecast, could translate itself into a quicker than anticipated recovery, particularly in the consumer-related sectors of the economy.

The Joint Economic Forecast was prepared by the German Institute for Economic Research (DIW Berlin), the ifo Institute (Munich), the Kiel Institute for the World Economy (IfW Kiel), the Halle Institute for Economic Research (IWH), and RWI (Essen).

The Joint Economic Forecast was prepared by the DIW (Berlin), the ifo Institute (Munich), the IfW (Kiel), the IWH (Halle), and the RWI (Essen).

Complete report (in German)

Joint Economic Forecast Project Group: Recovery Loses Momentum ‒ Economy and Politics Still Shaped by the Pandemic, Autumn 2020. Kiel 2020.

The complete version of the report (in German language) will be available on the IWH website and at www.gemeinschaftsdiagnose.de/category/gutachten/.

About the Joint Economic Forecast

The Joint Economic Forecast is published twice a year on behalf of the German Federal Ministry for Economic Affairs and Energy. The following institutes participated in the autumn report 2020:

- German Institute for Economic Research (DIW Berlin)

- ifo Institute – Leibniz Institute for Economic Research at the University of Munich

in cooperation with the KOF Swiss Economic Institute at ETH Zurich - Kiel Institute for the World Economy (IfW Kiel)

- Halle Institute for Economic Research (IWH) – Member of the Leibniz Association

- RWI – Leibniz Institute for Economic Research in cooperation with the Institute for Advanced Studies Vienna

Scientific Contacts

Dr. Claus Michelsen

German Institute for Economic Research (DIW Berlin)

Tel +49 30 89789 458

CMichelsen@diw.de

Professor Dr. Timo Wollmershäuser

ifo Institute – Leibniz Institute for Economic Research at the University of Munich

Tel +49 89 9224 1406

Wollmershaeuser@ifo.de

Professor Dr. Stefan Kooths

Kiel Institute for the World Economy (IfW Kiel)

Tel +49 431 8814 579 oder +49 30 2067 9664

Stefan.Kooths@ifw-kiel.de

Professor Dr. Oliver Holtemöller

Halle Institute for Economic Research (IWH) – Member of the Leibniz Association

Tel +49 345 7753 800

Oliver.Holtemoeller@iwh-halle.de

Professor Dr. Torsten Schmidt

RWI – Leibniz Institute for Economic Research

Tel +49 201 8149 287

Torsten.Schmidt@rwi-essen.de

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Erholung verliert an Fahrt – Wirtschaft und Politik weiter im Zeichen der Pandemie

in: Dienstleistungsauftrag des Bundesministeriums für Wirtschaft und Energie, 2, 2020

Abstract

Infolge der im In- und Ausland ergriffenen Maßnahmen zur Eindämmung der Corona-Pandemie ist die deutsche Wirtschaftsleistung in der ersten Jahreshälfte drastisch gesunken, wobei sich der Einbruch auf die Monate März und April konzentrierte. Schon im Mai setzte eine kräftige Gegenbewegung ein, die sich in nahezu allen Branchen bis zum aktuellen Rand fortsetzte. Dieser Erholungsprozess dürfte aber zunehmend an Fahrt verlieren. Denn Nachholeffekte laufen aus, einige Branchen sind weiterhin erheblichen Einschränkungen ausgesetzt und die für die deutsche Wirtschaft wichtige globale Investitionstätigkeit dürfte noch für einige Zeit geschwächt bleiben. Die Institute erwarten daher nach einem Rückgang des Bruttoinlandsproduktes um 5,4% in diesem Jahr nur ein Zuwachs um 4,7% im kommenden Jahr und 2,7% im Jahr 2022. Sie revidieren damit ihre Prognose gegenüber dem Frühjahr für das laufende und das kommende Jahr um jeweils gut 1 Prozentpunkt nach unten. Grund dafür ist, dass der weitere Erholungsprozess nunmehr etwas schwächer eingeschätzt wird als noch im Frühjahr.