Energy crisis in Germany

In late summer 2022, the global economy is in a downturn. Persistently high inflation rates have prompted the US Federal Reserve and many other central banks to start tightening their monetary policy. In the wake of the pandemic, policymakers worldwide had responded to restrictions on the supply of goods with massive stimulus packages intended to stoke demand. This has contributed to upward price pressures. Since the outbreak of the Ukraine war, energy has become scarcer and more expensive. This has given rise to an energy crisis in Europe, where gas supplies from Russia cannot be fully substituted. The sharp rise in import prices will likely trigger a recession over the winter in the euro area, mainly through the loss of real income for private households. Alongside the USA and Europe, the third global economic center, China, is also experiencing a downturn. The economic fallout from continuous lockdowns, necessary to sustain the country’s strict zero-COVID strategy, and a smoldering real estate crisis are weighing on the Chinese economy.

The German economy is facing a recession driven by the massive rise in prices for fossil fuels. The wholesale price of natural gas in Europe is currently around five times higher than a year ago. It is to be expected that the prices paid by German importers and private households will converge to wholesale prices in the coming months. While the cost of net imports of natural gas into Germany relative to GDP was about ¾% last year, this figure is expected to increase strongly for 2022 and 2023, thereby exceeding the hike in costs resulting from the two oil crises in the 1970s of about 2% relative to GDP.

“As a consequence, firms in the manufacturing sector will lose international competitiveness,” says Oliver Holtemöller, head of the Macroeconomics Department and vice president at the IWH. The brunt will however be borne by private households in the form of higher heating and electricity cost, despite political efforts to protect particularly hard-hit sections of the population. “Private households will be forced to cut back on other consumer spending, resulting in a decline in overall economic output,” Holtemöller says.

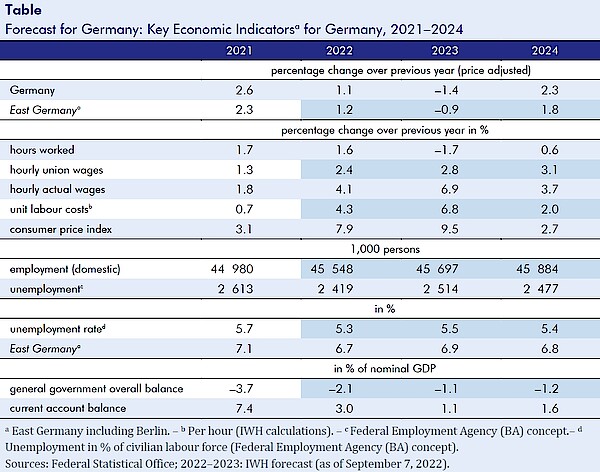

While the labour force will continue to expand, albeit at a significantly slower rate, working hours per employee will decline over the winter and there will be more short time working again. High energy and raw material prices will cause the German current account balance to fall significantly from 7.4% as a percentage of GDP in 2021 to 1.1% in 2023. The general government deficit is expected to fall from 3.7% of GDP in 2021 to 2.1% this year and 1.1% in 2023, because tax and contribution revenues will again increase significantly with the strong growth in nominal GDP. The expiration of pandemic aid and relief packages is also contributing to this decline.

The long version of the forecast contains two boxes (both in German):

Box 1: Assumptions for the forecast

Box 2: Estimation of potential output

Publication: Drygalla, Andrej; Exß, Franziska; Heinisch, Katja; Holtemöller, Oliver; Kämpfe, Martina; Kozyrev, Boris; Lindner, Axel; Müller, Isabella; Sardone, Alessandro; Scherer, Jan-Christopher; Schult, Christoph; Schultz, Birgit; Staffa, Ruben; Zeddies, Götz: Krieg treibt Energiepreise – Hohe Inflation belastet Konjunktur. IWH, Konjunktur aktuell, Jg. 10 (3), 2022. Halle (Saale) 2022.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Konjunktur aktuell: Energiekrise in Deutschland

in: Konjunktur aktuell, 3, 2022

Abstract

Im Spätsommer 2022 ist die Weltwirtschaft im Abschwung. Die US-Notenbank und weitere Zentralbanken haben aufgrund der hohen Inflation mit der Straffung ihrer Geldpolitik begonnen, die chinesische Konjunktur schwächelt, und Europa kämpft mit einer Energiekrise. Die deutsche Wirtschaft steht aufgrund der stark steigenden Energiekosten vor einer Rezession. Das deutsche Bruttoinlandsprodukt wird im Jahr 2022 um 1,1% zunehmen und im Jahr 2023 um 1,4% sinken. Die Verbraucherpreise steigen im Jahr 2022 um 7,9% und im Jahr 2023 um 9,5%.