Gas storages full – economic outlook less gloomy

In spring 2023, opposing forces affect the global economy: The end of the pandemic and lockdowns in China will provide a boost for the Asian region in particular. However, continuing high inflation in most advanced economies is having a negative impact. Although rates of consumer price inflation are falling, this is mainly due to lower energy prices, and core rates remain high. Key interest rates will therefore be raised further. This will dampen demand in 2023, in particular in the construction sector. Supply bottlenecks, meanwhile, will become less important as a constraint on the supply side. Overall, the international economy will remain weak in 2023, with a stagnant first half in the euro are and a mild recession in the USA in the second half.

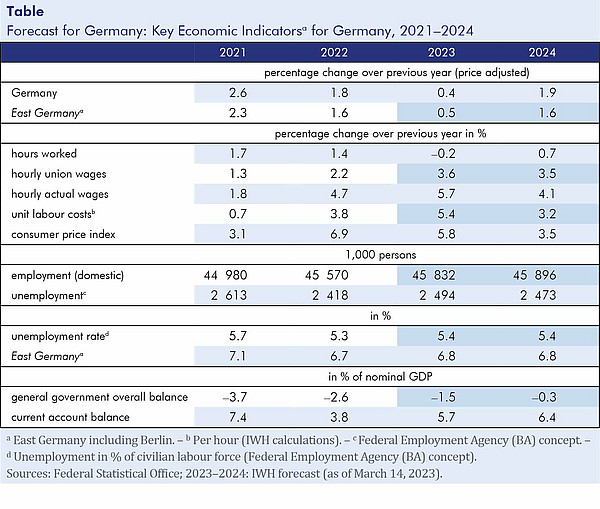

In Germany, gross domestic product fell by 0.4% in the final quarter of 2022, but for the beginning of this year, leading indicators point to a slight increase, and firms have continued to expand employment. European energy and especially gas prices have fallen sharply from their record levels in late summer 2022. Thus, the terms-of-trade shock to the German economy was much milder than expected. There was no need to ration gas, partly because firms and private households significantly reduced their consumption of natural gas. In addition, not least because of the rapid installation of LNG terminals, the risk of an energy crisis for the winter of 2023/2024 has decreased significantly. Gas and electricity prices for private households are likely to be lower or only slightly higher on average than the prices guaranteed by the state for 80% of the volume last consumed by the individual household. Yet the economy is likely to remain weak, says Oliver Holtemöller, head of the Macroeconomics Department and vice president at the IWH. Despite its decline, the cost of energy is still significantly higher than it was before the gas shortage began in Europe in summer 2021. In the manufacturing sector, some energy-intensive goods are therefore currently not produced in Germany, but are imported instead. In addition, even without the energy and food components, inflation was at record highs at the beginning of 2023, and real disposable incomes of private households are falling. “To combat inflation, the European Central Bank (ECB) is tightening its monetary policy sharply, and higher financing costs are exacerbating the cost crisis in the German construction sector,” Holtemöller says. According to the economic expert, demand from abroad is unlikely to provide much stimulus, as the global economy is in a downturn. While there is a chance that exports to China will pick up again in 2023 following the end of the lockdown there, another major destination for German exports, the USA, is likely to fall into recession.

The extended version of the forecast contains two boxes (all in German):

Box 1: Cost crisis in the construction industry

Box 2: Estimation of potential output

Publication:

Drygalla, Andrej; Exß, Franziska; Heinisch, Katja; Holtemöller, Oliver; Kämpfe, Martina; Kozyrev, Boris; Lindner, Axel; Sardone, Alessandro; Schult, Christoph; Schultz, Birgit; Staffa, Ruben; Zeddies, Götz: Konjunktur aktuell: Gasspeicher voll – Konjunkturaussichten weniger trüb. IWH, Konjunktur aktuell, Jg. 11 (1), 2023. Halle (Saale) 2023.

Whom to contact

For Researchers

Vice President Department Head

If you have any further questions please contact me.

+49 345 7753-800 Request per E-MailFor Journalists

Internal and External Communications

If you have any further questions please contact me.

+49 345 7753-832 Request per E-MailIWH list of experts

The IWH list of experts provides an overview of IWH research topics and the researchers and scientists in these areas. The relevant experts for the topics listed there can be reached for questions as usual through the IWH Press Office.

Related Publications

Konjunktur aktuell: Gasspeicher voll – Konjunkturaussichten weniger trüb

in: Konjunktur aktuell, 1, 2023

Abstract

Im Frühjahr 2023 wirken gegenläufige Kräfte auf die Weltwirtschaft: Das Ende des Corona-Lockdowns in China gibt vor allem dem asiatischen Raum einen Schub, doch die anhaltend hohe Inflation belastet die fortgeschrittenen Volkswirtschaften weltweit. Alles in allem bleibt die internationale Konjunktur 2023 schwach. Für die deutsche Wirtschaft blieb der vielfach erwartete deutliche Einbruch aus, denn die Gasversorgungslage hat sich zunächst stabilisiert. Dennoch dürfte die Konjunktur wegen der Energiekosten, hoher Inflation, gestiegener Realzinsen und rückläufiger Realeinkommen schwach bleiben. Das Bruttoinlandsprodukt dürfte im Jahr 2023 um lediglich 0,4% zulegen, und die Inflationsrate bleibt mit 5,8% hoch.