Productivity: More with Less by Better

Available resources are scarce. To sustain our society's income and living standards in a world with ecological and demographic change, we need to make smarter use of them.

Dossier

In a nutshell

Nobel Prize winners Paul Samuelson and William Nordhaus state in their classic economics textbook: Economics matters because resources are scarce. Indeed, productivity research is at the very heart of economics as it describes the efficiency with which these scarce resources are transformed into goods and services and, hence, into social wealth. If the consumption of resources is to be reduced, e. g., due to ecological reasons, our society’s present material living standards can only be maintained by productivity growth. The aging of our society and the induced scarcity of labour is a major future challenge. Without productivity growth a solution is hard to imagine. To understand the processes triggering productivity growth, a look at micro data on the level of individual firms or establishments is indispensable.

Our experts

Department Head

If you have any further questions please contact me.

+49 345 7753-708 Request per E-Mail

President

If you have any further questions please contact me.

+49 345 7753-700 Request per E-MailAll experts, press releases, publications and events on “Productivity”

Productivity is output in relation to input. While the concept of total factor productivity describes how efficiently labour, machinery, and all combined inputs are used, labour productivity describes value added (Gross Domestic Product, GDP) per worker and measures, in a macroeconomic sense, income per worker.

Productivity Growth on the Slowdown

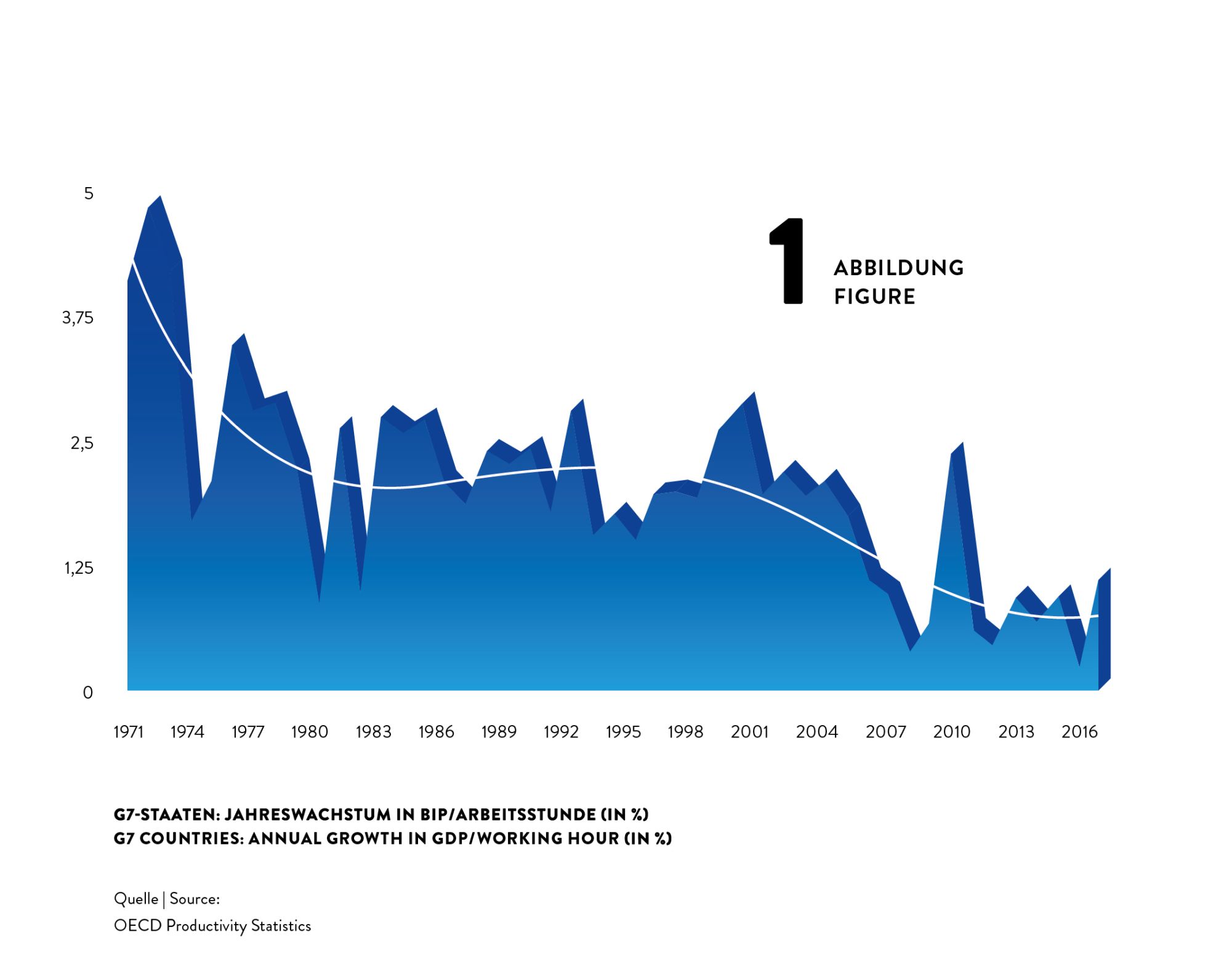

Surprisingly, despite of massive use of technology and rushing digitisation, advances in productivity have been slowing down during the last decades. Labour productivity growth used to be much higher in the 1960s and 1970s than it is now. For the G7 countries, for example, annual growth rates of GDP per hour worked declined from about 4% in the early 1970s to about 2% in the 1980s and 1990s and then even fell to about 1% after 2010 (see figure 1).

This implies a dramatic loss in potential income: Would the 4% productivity growth have been sustained over the four and a half decades from 1972 to 2017, G7 countries’ GDP per hour would now be unimaginable 2.5 times as high as it actually is. What a potential to, for instance, reduce poverty or to fund research on fundamentals topics as curing cancer or using fusion power!

So why has productivity growth declined dramatically although at the same time we see, for instance, a boom in new digital technologies that can be expected to increase productivity growth? For sure, part of the decline might be spurious and caused by mismeasurement of the contributions of digital technologies. For instance, it is inherently difficult to measure the value of a google search or another video on youtube. That being said, most observers agree that part of the slowdown is real.

Techno-Pessimists and Techno-Optimists

Techno-pessimists say, well, these new technologies are just not as consequential for productivity as, for instance, electrification or combustion engines have been. Techno-optimists argue that it can take many years until productivity effects of new technologies kick in, and it can come in multiple waves. New technology we have now may just be the tools to invent even more consequential innovations in the future.

While this strand of the discussion is concerned with the type of technology invented, others see the problem in that inventions nowadays may diffuse slowly from technological leaders to laggards creating a wedge between few superstar firms and the crowd (Akcigit et al., 2021). Increased market concentration and market power by superstar firms may reduce competitive pressure and the incentives to innovate.

Finally, reduced Schumpeterian business dynamism, i.e. a reduction in firm entry and exit as well as firm growth and decline, reflects a slowdown in the speed with which production factors are recombined to find their most productive match.

While the explanation for and the way out of the productivity puzzle are still unknown, it seems understood that using granular firm level data is the most promising path to find answers.

What are the Origins of Productivity Growth?

Aggregate productivity growth can originate from (i) a more efficient use of available inputs at the firm level as described above or (ii) from an improved allocation of resources between firms.

Higher efficiency at the firm level captures, e.g., the impact of innovations (Acemoglu et al., 2018) or improved firm organisation (management) (Heinz et al., 2020; Müller und Stegmaier, 2017), while improved factor allocation describes the degree of which scarce input factors are re-allocated from inefficient to efficient firms (‘Schumpeterian creative destruction’) (Aghion et al., 2015; Decker et al., 2021).

Most economic processes influence the productivity of existing firms and the growth and the use of resources of these firms and their competitors as well. The accelerated implementation of robotics in German plants (Deng et al., 2020), the foreign trade shocks induced by the rise of the Chinese economy (Bräuer et al., 2019), but also the COVID-19 pandemic, whose consequences are still to evaluate (Müller, 2021) not only effects on productivity and growth of the firms directly affected but at the same time may create new businesses and question existing firms.

While productivity can be measured at the level of aggregated sectors or economies, micro data on the level of individual firms or establishments are indispensable to study firm organisation, technology and innovation diffusion, superstar firms, market power, factor allocation and Schumpeterian business dynamism. The IWH adopts this micro approach within the EU Horizon 2020 project MICROPROD as well as with the CompNet research network.

As “creative destruction” may also negatively affect the persons involved (e. g., in the case of layoffs, Fackler et al., 2021), the IWH analyses the consequences of bankruptcies in its Bankruptcy Research Unit and looks at the implications of creative destruction for the society, e. g., within a project funded by Volkswagen Foundation searching for the economic origins of populism and in the framework of the Institute for Research on Social Cohesion.

Publications on “Productivity”

Wirtschaftliche Folgen des Gaspreisanstiegs für die deutsche Industrie

in: Wirtschaft im Wandel, No. 1, 2023

Abstract

<p>Die Gaspreise haben sich in Deutschland infolge des Lieferstopps russischen Erdgases deutlich erhöht, mit möglichen Folgen für die Wettbewerbsfähigkeit der deutschen Industrie. Wir berechnen den Gasverbrauch auf Produktebene für die Zeit vor der Energiekrise mit Hilfe der Mikrodaten der amtlichen Statistik, um zielgenau abschätzen zu können, bei welchen Produkten eine Drosselung der Produktion zur maximalen Gaseinsparung bei minimalen wirtschaftlichen Verlusten führen würde. Die Verwendung von Mikrodaten zeigt, dass die Folgen für Umsatz und Wertschöpfung in der Industrie bei Weitem nicht so negativ ausfallen werden wie von vielen befürchtet.</p>

Robots, Occupations, and Worker Age: A Production-unit Analysis of Employment

in: IWH Discussion Papers, No. 5, 2023

Abstract

We analyse the impact of robot adoption on employment composition using novel micro data on robot use in German manufacturing plants linked with social security records and data on job tasks. Our task-based model predicts more favourable employment effects for the least routine-task intensive occupations and for young workers, with the latter being better at adapting to change. An event-study analysis of robot adoption confirms both predictions. We do not find adverse employment effects for any occupational or age group, but churning among low-skilled workers rises sharply. We conclude that the displacement effect of robots is occupation biased but age neutral, whereas the reinstatement effect is age biased and benefits young workers most.

Do Larger Firms Exert More Market Power? Markups and Markdowns along the Size Distribution

in: IWH Discussion Papers, No. 1, 2023

Abstract

Several models posit a positive cross-sectional correlation between markups and firm size, which characterizes misallocation, factor shares, and gains from trade. Accounting for labor market power in markup estimation, we find instead that larger firms have lower product markups but higher wage markdowns. The negative markup-size correlation turns positive when conditioning on markdowns, suggesting interactions between product and labor market power. Our findings are robust to common criticism (e.g., price bias, non-neutral technology) and hold across 19 European countries. We discuss possible mechanisms and resulting implications, highlighting the importance of studying input and output market power in a unified framework.

Do Larger Firms Exert More Market Power? Markups and Markdowns along the Size Distribution

in: IWH-CompNet Discussion Papers, No. 1, 2023

Abstract

Several models posit a positive cross-sectional correlation between markups and firm size, which characterizes misallocation, factor shares, and gains from trade. Accounting for labor market power in markup estimation, we find instead that larger firms have lower product markups but higher wage markdowns. The negative markup-size correlation turns positive when conditioning on markdowns, suggesting interactions between product and labor market power. Our findings are robust to common criticism (e.g., price bias, non-neutral technology) and hold across 19 European countries. We discuss possible mechanisms and resulting implications, highlighting the importance of studying input and output market power in a unified framework.

Automation with Heterogeneous Agents: The Effect on Consumption Inequality

in: IWH Discussion Papers, No. 28, 2022

Abstract

In this paper, I study technological change as a candidate for the observed increase in consumption inequality in the United States. I build an incomplete market model with educational choice combined with a task-based model on the production side. I consider two channels through which technology affects inequality: the skill that an agent can supply in the labor market and the level of capital she owns. In a quantitative analysis, I show that (i) the model replicates the increase in consumption inequality between 1981 and 2008 in the US (ii) educational choice and the return to wealth are quantitatively important in explaining the increase in consumption inequality.