Productivity: More with Less by Better

Available resources are scarce. To sustain our society's income and living standards in a world with ecological and demographic change, we need to make smarter use of them.

Dossier

In a nutshell

Nobel Prize winners Paul Samuelson and William Nordhaus state in their classic economics textbook: Economics matters because resources are scarce. Indeed, productivity research is at the very heart of economics as it describes the efficiency with which these scarce resources are transformed into goods and services and, hence, into social wealth. If the consumption of resources is to be reduced, e. g., due to ecological reasons, our society’s present material living standards can only be maintained by productivity growth. The aging of our society and the induced scarcity of labour is a major future challenge. Without productivity growth a solution is hard to imagine. To understand the processes triggering productivity growth, a look at micro data on the level of individual firms or establishments is indispensable.

Our experts

Department Head

If you have any further questions please contact me.

+49 345 7753-708 Request per E-Mail

President

If you have any further questions please contact me.

+49 345 7753-700 Request per E-MailAll experts, press releases, publications and events on “Productivity”

Productivity is output in relation to input. While the concept of total factor productivity describes how efficiently labour, machinery, and all combined inputs are used, labour productivity describes value added (Gross Domestic Product, GDP) per worker and measures, in a macroeconomic sense, income per worker.

Productivity Growth on the Slowdown

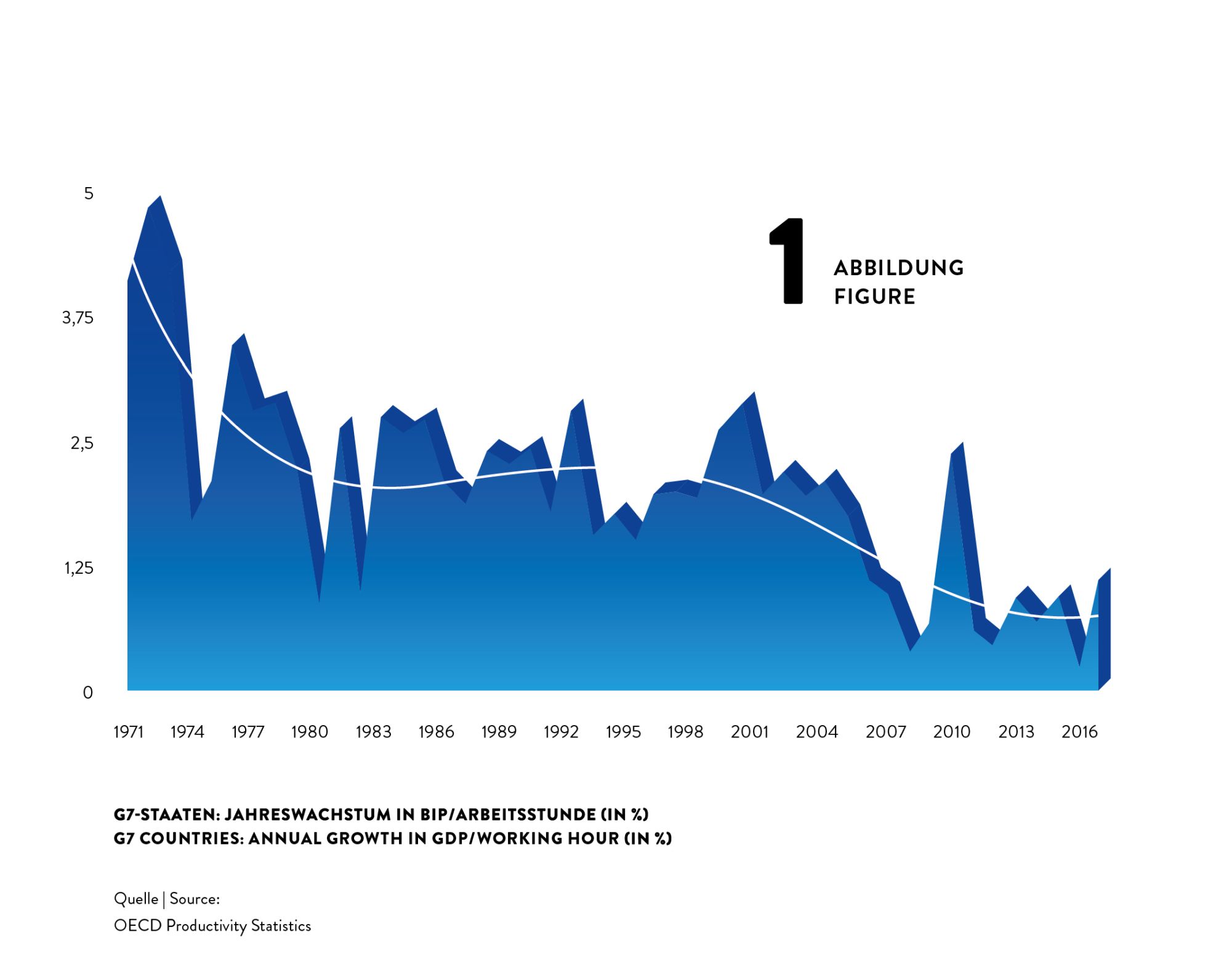

Surprisingly, despite of massive use of technology and rushing digitisation, advances in productivity have been slowing down during the last decades. Labour productivity growth used to be much higher in the 1960s and 1970s than it is now. For the G7 countries, for example, annual growth rates of GDP per hour worked declined from about 4% in the early 1970s to about 2% in the 1980s and 1990s and then even fell to about 1% after 2010 (see figure 1).

This implies a dramatic loss in potential income: Would the 4% productivity growth have been sustained over the four and a half decades from 1972 to 2017, G7 countries’ GDP per hour would now be unimaginable 2.5 times as high as it actually is. What a potential to, for instance, reduce poverty or to fund research on fundamentals topics as curing cancer or using fusion power!

So why has productivity growth declined dramatically although at the same time we see, for instance, a boom in new digital technologies that can be expected to increase productivity growth? For sure, part of the decline might be spurious and caused by mismeasurement of the contributions of digital technologies. For instance, it is inherently difficult to measure the value of a google search or another video on youtube. That being said, most observers agree that part of the slowdown is real.

Techno-Pessimists and Techno-Optimists

Techno-pessimists say, well, these new technologies are just not as consequential for productivity as, for instance, electrification or combustion engines have been. Techno-optimists argue that it can take many years until productivity effects of new technologies kick in, and it can come in multiple waves. New technology we have now may just be the tools to invent even more consequential innovations in the future.

While this strand of the discussion is concerned with the type of technology invented, others see the problem in that inventions nowadays may diffuse slowly from technological leaders to laggards creating a wedge between few superstar firms and the crowd (Akcigit et al., 2021). Increased market concentration and market power by superstar firms may reduce competitive pressure and the incentives to innovate.

Finally, reduced Schumpeterian business dynamism, i.e. a reduction in firm entry and exit as well as firm growth and decline, reflects a slowdown in the speed with which production factors are recombined to find their most productive match.

While the explanation for and the way out of the productivity puzzle are still unknown, it seems understood that using granular firm level data is the most promising path to find answers.

What are the Origins of Productivity Growth?

Aggregate productivity growth can originate from (i) a more efficient use of available inputs at the firm level as described above or (ii) from an improved allocation of resources between firms.

Higher efficiency at the firm level captures, e.g., the impact of innovations (Acemoglu et al., 2018) or improved firm organisation (management) (Heinz et al., 2020; Müller und Stegmaier, 2017), while improved factor allocation describes the degree of which scarce input factors are re-allocated from inefficient to efficient firms (‘Schumpeterian creative destruction’) (Aghion et al., 2015; Decker et al., 2021).

Most economic processes influence the productivity of existing firms and the growth and the use of resources of these firms and their competitors as well. The accelerated implementation of robotics in German plants (Deng et al., 2020), the foreign trade shocks induced by the rise of the Chinese economy (Bräuer et al., 2019), but also the COVID-19 pandemic, whose consequences are still to evaluate (Müller, 2021) not only effects on productivity and growth of the firms directly affected but at the same time may create new businesses and question existing firms.

While productivity can be measured at the level of aggregated sectors or economies, micro data on the level of individual firms or establishments are indispensable to study firm organisation, technology and innovation diffusion, superstar firms, market power, factor allocation and Schumpeterian business dynamism. The IWH adopts this micro approach within the EU Horizon 2020 project MICROPROD as well as with the CompNet research network.

As “creative destruction” may also negatively affect the persons involved (e. g., in the case of layoffs, Fackler et al., 2021), the IWH analyses the consequences of bankruptcies in its Bankruptcy Research Unit and looks at the implications of creative destruction for the society, e. g., within a project funded by Volkswagen Foundation searching for the economic origins of populism and in the framework of the Institute for Research on Social Cohesion.

Publications on “Productivity”

The (Heterogeneous) Economic Effects of Private Equity Buyouts

in: Management Science, forthcoming

Abstract

<p>The effects of private equity buyouts on employment, productivity, and job reallocation vary tremendously with macroeconomic and credit conditions, across private equity groups, and by type of buyout. We reach this conclusion by examining the most extensive database of U.S. buyouts ever compiled, encompassing thousands of buyout targets from 1980 to 2013 and millions of control firms. Employment shrinks 12% over two years after buyouts of publicly listed firms—on average, and relative to control firms—but expands 15% after buyouts of privately held firms. Postbuyout productivity gains at target firms are large on average and much larger yet for deals executed amid tight credit conditions. A postbuyout tightening of credit conditions or slowing of gross domestic product growth curtails employment growth and intrafirm job reallocation at target firms. We also show that buyout effects differ across the private equity groups that sponsor buyouts, and these differences persist over time at the group level. Rapid upscaling in deal flow at the group level brings lower employment growth at target firms. We relate these findings to theories of private equity that highlight agency problems at portfolio firms and within the private equity industry itself.</p>

Wie Roboter die betriebliche Beschäftigungsstruktur verändern

in: Wirtschaft im Wandel, No. 1, 2025

Abstract

<p>Der Einsatz von Robotern verändert die Arbeitswelt grundlegend – doch welche spezifischen Effekte hat dies auf die Beschäftigungsstruktur? Unsere Analyse untersucht die Folgen des Robotereinsatzes anhand neuartiger Mikrodaten aus deutschen Industriebetrieben. Diese Daten verknüpfen Informationen zum Robotereinsatz mit Sozialversicherungsdaten und detaillierten Angaben zu Arbeitsaufgaben. Auf Basis eines theoretischen Modells leiten wir insbesondere positive Beschäftigungseffekte für Berufe mit wenig repetitiven, programmierbaren Aufgaben ab, sowie für jüngere Arbeitskräfte, weil diese sich besser an technologische Veränderungen anpassen können. Die empirische, mikroökonomische Analyse des Robotereinsatzes auf Betriebsebene bestätigt diese Vorhersagen: Die Beschäftigung steigt für Techniker, Ingenieure und Manager und junge Beschäftigte, während sie bei geringqualifizierten Routineberufen sowie bei Älteren stagniert. Zudem steigt die Fluktuation bei geringqualifizierten Arbeitskräften signifikant an. Unsere Ergebnisse verdeutlichen, dass der Verdrängungseffekt von Robotern berufsabhängig ist, während junge Arbeitskräfte neue Tätigkeiten übernehmen.</p>

Credit Card Entrepreneurs

in: IWH Discussion Papers, No. 5, 2025

Abstract

<p>Utilizing near real-time QuickBooks data from over 1.6 million small businesses and a targeted survey, this paper highlights the critical role credit card financing plays for small business activity. We examine a two year period beginning in January of 2021. A turbulent period during which, credit card usage by small U.S. businesses nearly doubled, interest payments rose by 60%, and delinquencies reached 2.8%. We find, first, monthly credit card payments were up to three times higher than loan payments during this time. Second, we use targeted surveys of these small businesses to establish credit cards as a key financing source in response to firm-level shocks, such as uncertain cash flows and overdue invoices. Third, we establish the importance of credit cards as an important financial transmission mechanism. Following the Federal Reserve’s rate hikes in early 2022, banks cut credit card supply, leading to a 15.75% drop in balances and a 10% decline in revenue growth, as well as a 1.5% decrease in employment growth among U.S. small businesses. These higher rates also rendered interest payments unsustainable for many, contributing to half of the observed increase in delinquencies. Lastly, a simple heterogeneous firm model with a cash-in-hand constraint illustrates the significant macroeconomic impact of credit card financing on small business activity.</p>

Wie Arbeitsplatzzusagen die Unternehmensdynamiken beeinflussen

in: Wirtschaft im Wandel, No. 4, 2024

Abstract

<p>Arbeitsplatzzusagen stellen eine häufig genutzte industriepolitische Maßnahme dar. Die zugrundeliegende Studie evaluiert die Wirkungen von Arbeitsplatzzusagen zum Zeitpunkt der Privatisierung der Unternehmen in Ostdeutschland nach der Wiedervereinigung. Diese industriepolitische Maßnahme verlangte von den neuen Eigentümern der Unternehmen, sich zu Beschäftigungszielen zu verpflichten, wobei Strafen für Nichteinhaltung vertraglich vereinbart waren. Die Studie zeigt, dass Arbeitsplatzzusagen zu einer Polarisierung und Fehlallokation führen. Während Unternehmen mit geringer Produktivität aus dem Markt gedrängt werden, führt das industriepolitische Instrument zu Verzerrungen in der Unternehmensgröße. Um diese Verzerrungen abzubauen, haben Unternehmen einen Anreiz, in Produktivität zu investieren. Im Vergleich mit produktivitätssteigernden Subventionen zeigen sich Arbeitsplatzzusagen langfristig als weniger nachhaltig und generieren geringere Beschäftigungseffekte.</p>

Training, Automation, and Wages: International Worker-level Evidence

in: IWH Discussion Papers, No. 27, 2024

Abstract

<p>Job training is widely regarded as crucial for protecting workers from automation, yet there is a lack of empirical evidence to support this belief. Using internationally harmonized data from over 90,000 workers across 37 industrialized countries, we construct an individual-level measure of automation risk based on tasks performed at work. Our analysis reveals substantial within-occupation variation in automation risk, overlooked by existing occupation-level measures. To assess whether job training mitigates automation risk, we exploit within-occupation and within-industry variation. Additionally, we employ entropy balancing to re-weight workers without job training based on a rich set of background characteristics, including tested numeracy skills as a proxy for unobserved ability. We find that job training reduces workers’ automation risk by 4.7 percentage points, equivalent to 10 percent of the average automation risk. The training-induced reduction in automation risk accounts for one-fifth of the wage returns to job training. Job training is effective in reducing automation risk and increasing wages across nearly all countries, underscoring the external validity of our findings. Women tend to benefit more from training than men, with the advantage becoming particularly pronounced at older ages.</p>