Productivity: More with Less by Better

Available resources are scarce. To sustain our society's income and living standards in a world with ecological and demographic change, we need to make smarter use of them.

Dossier

In a nutshell

Nobel Prize winners Paul Samuelson and William Nordhaus state in their classic economics textbook: Economics matters because resources are scarce. Indeed, productivity research is at the very heart of economics as it describes the efficiency with which these scarce resources are transformed into goods and services and, hence, into social wealth. If the consumption of resources is to be reduced, e. g., due to ecological reasons, our society’s present material living standards can only be maintained by productivity growth. The aging of our society and the induced scarcity of labour is a major future challenge. Without productivity growth a solution is hard to imagine. To understand the processes triggering productivity growth, a look at micro data on the level of individual firms or establishments is indispensable.

Our experts

Department Head

If you have any further questions please contact me.

+49 345 7753-708 Request per E-Mail

President

If you have any further questions please contact me.

+49 345 7753-700 Request per E-MailAll experts, press releases, publications and events on “Productivity”

Productivity is output in relation to input. While the concept of total factor productivity describes how efficiently labour, machinery, and all combined inputs are used, labour productivity describes value added (Gross Domestic Product, GDP) per worker and measures, in a macroeconomic sense, income per worker.

Productivity Growth on the Slowdown

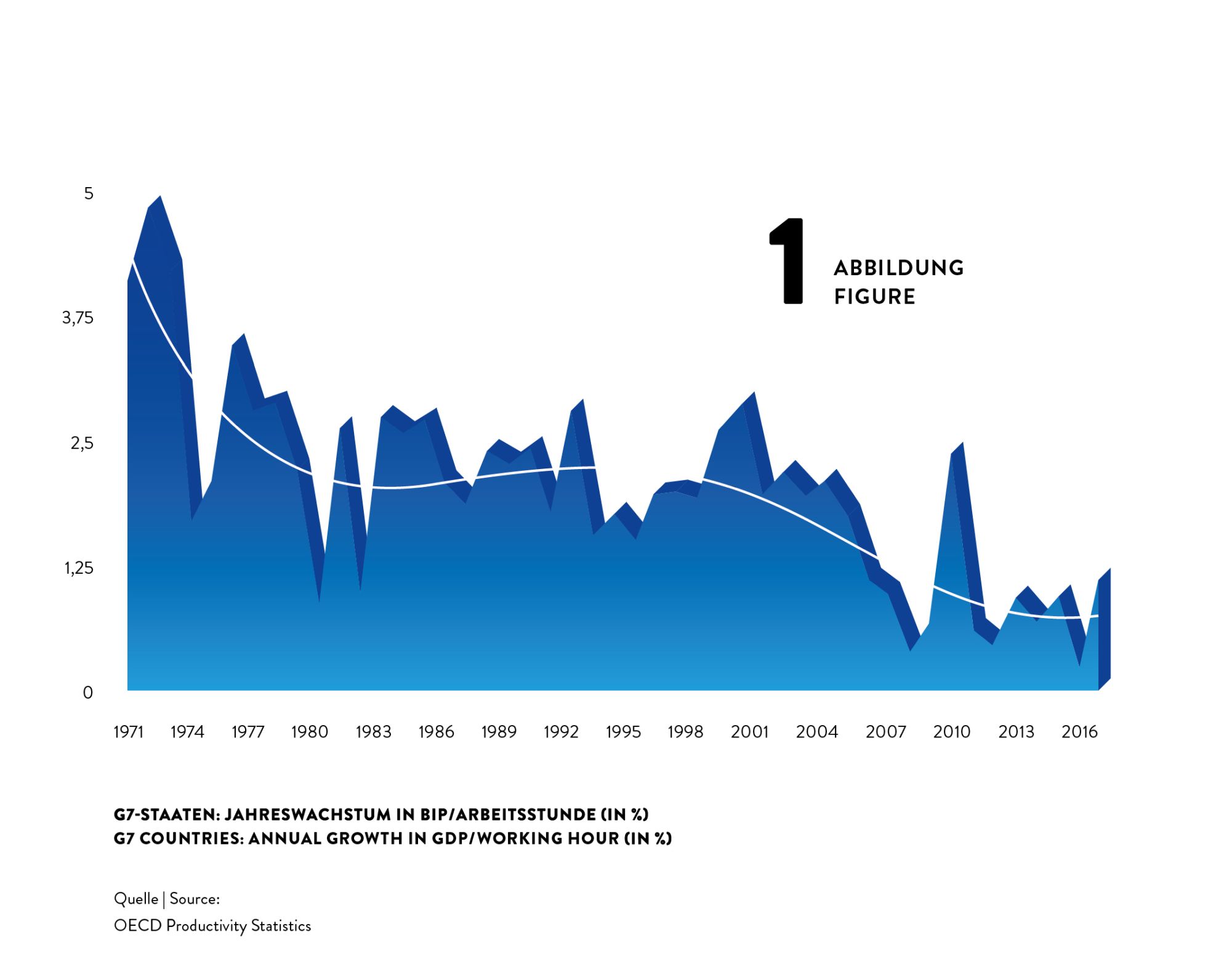

Surprisingly, despite of massive use of technology and rushing digitisation, advances in productivity have been slowing down during the last decades. Labour productivity growth used to be much higher in the 1960s and 1970s than it is now. For the G7 countries, for example, annual growth rates of GDP per hour worked declined from about 4% in the early 1970s to about 2% in the 1980s and 1990s and then even fell to about 1% after 2010 (see figure 1).

This implies a dramatic loss in potential income: Would the 4% productivity growth have been sustained over the four and a half decades from 1972 to 2017, G7 countries’ GDP per hour would now be unimaginable 2.5 times as high as it actually is. What a potential to, for instance, reduce poverty or to fund research on fundamentals topics as curing cancer or using fusion power!

So why has productivity growth declined dramatically although at the same time we see, for instance, a boom in new digital technologies that can be expected to increase productivity growth? For sure, part of the decline might be spurious and caused by mismeasurement of the contributions of digital technologies. For instance, it is inherently difficult to measure the value of a google search or another video on youtube. That being said, most observers agree that part of the slowdown is real.

Techno-Pessimists and Techno-Optimists

Techno-pessimists say, well, these new technologies are just not as consequential for productivity as, for instance, electrification or combustion engines have been. Techno-optimists argue that it can take many years until productivity effects of new technologies kick in, and it can come in multiple waves. New technology we have now may just be the tools to invent even more consequential innovations in the future.

While this strand of the discussion is concerned with the type of technology invented, others see the problem in that inventions nowadays may diffuse slowly from technological leaders to laggards creating a wedge between few superstar firms and the crowd (Akcigit et al., 2021). Increased market concentration and market power by superstar firms may reduce competitive pressure and the incentives to innovate.

Finally, reduced Schumpeterian business dynamism, i.e. a reduction in firm entry and exit as well as firm growth and decline, reflects a slowdown in the speed with which production factors are recombined to find their most productive match.

While the explanation for and the way out of the productivity puzzle are still unknown, it seems understood that using granular firm level data is the most promising path to find answers.

What are the Origins of Productivity Growth?

Aggregate productivity growth can originate from (i) a more efficient use of available inputs at the firm level as described above or (ii) from an improved allocation of resources between firms.

Higher efficiency at the firm level captures, e.g., the impact of innovations (Acemoglu et al., 2018) or improved firm organisation (management) (Heinz et al., 2020; Müller und Stegmaier, 2017), while improved factor allocation describes the degree of which scarce input factors are re-allocated from inefficient to efficient firms (‘Schumpeterian creative destruction’) (Aghion et al., 2015; Decker et al., 2021).

Most economic processes influence the productivity of existing firms and the growth and the use of resources of these firms and their competitors as well. The accelerated implementation of robotics in German plants (Deng et al., 2020), the foreign trade shocks induced by the rise of the Chinese economy (Bräuer et al., 2019), but also the COVID-19 pandemic, whose consequences are still to evaluate (Müller, 2021) not only effects on productivity and growth of the firms directly affected but at the same time may create new businesses and question existing firms.

While productivity can be measured at the level of aggregated sectors or economies, micro data on the level of individual firms or establishments are indispensable to study firm organisation, technology and innovation diffusion, superstar firms, market power, factor allocation and Schumpeterian business dynamism. The IWH adopts this micro approach within the EU Horizon 2020 project MICROPROD as well as with the CompNet research network.

As “creative destruction” may also negatively affect the persons involved (e. g., in the case of layoffs, Fackler et al., 2021), the IWH analyses the consequences of bankruptcies in its Bankruptcy Research Unit and looks at the implications of creative destruction for the society, e. g., within a project funded by Volkswagen Foundation searching for the economic origins of populism and in the framework of the Institute for Research on Social Cohesion.

Publications on “Productivity”

Interview: Gibt es aktuell eine Insolvenzwelle in Deutschland?

in: Wirtschaft im Wandel, No. 3, 2024

Abstract

<p>In den letzten Wochen gab es zahlreiche Medienberichte zu Insolvenzen in Deutschland, darunter einige bekannte Namen. Befinden wir uns in einer Insolvenzwelle? Dazu sprechen wir mit dem Insolvenz-Experten Professor Dr. Steffen Müller vom Leibniz-Institut für Wirtschaftsforschung Halle (IWH).</p>

Productivity, Place, and Plants

in: Review of Economics and Statistics, No. 5, 2024

Abstract

Why do cities differ so much in productivity? A long literature has sought out systematic sources, such as inherent productivity advantages, market access, agglomeration forces, or sorting. We document that up to three quarters of the measured regional productivity dispersion is spurious, reflecting the “luck of the draw” of finite counts of idiosyncratically heterogeneous plants that happen to operate in a given location. The patterns are even more pronounced for new plants, hold for alternative productivity measures, and broadly extend to European countries. This large role for individual plants suggests a smaller role for places in driving regional differences.

„Evaluation der Gemeinschaftsaufgabe ‚Verbesserung der regionalen Wirtschaftsstruktur‘ (GRW)“ durch einzelbetriebliche Erfolgskontrolle – Evaluationsbericht –

in: IWH Studies, No. 3, 2024

Abstract

<p>Gegenstand dieses Evaluationsberichts ist die Replikation und Erweiterung der Ergebnisse des vorhergehenden Gutachtens zur <a class="link-external-blank" href="https://www.iwh-halle.de/publikationen/detail/evaluation-der-gemeinschaftsaufgabe-verbesserung-der-regionalen-wirtschaftsstruktur-grw-durch-einzelbetriebliche-erfolgskontrolle" target="_blank">Evaluation der Gemeinschaftsaufgabe ‚Verbesserung der regionalen Wirtschaftsstruktur‘ (GRW)</a> </p> <p>Der vorliegende Evaluationsbericht verfolgt zwei Ziele. Erstens aktualisiert er die Ergebnisse aus dem vorherigen Gutachten. Zweitens betrachtet er einige Aspekte zu den Wirkungen der GRW-Förderung vertiefend. Dazu gehört insbesondere die Frage, ob die GRW für die geförderten Betriebe tatsächlich einen Anreizeffekt im Sinne einer Ausweitung der Investitionstätigkeit hatte und wie sich die Effekte der Förderung unter Verwendung fortgeschrittener Produktivitätsmaße darstellt. Des Weiteren widmet sich der Evaluationsbericht einer vertiefenden Untersuchung heterogener Effekte auf sektoral disaggregierter Ebene sowie nach Betriebsgrößenklassen. Wo es möglich ist, analysiert der Bericht zudem längere Zeiträume nach dem Beginn des Förderprojekts. Schließlich widmet sich der Evaluationsbericht Fragen zur Wirtschaftlichkeit des GRW-Programms auf einzelbetrieblicher Ebene, indem er die Effekte in Beziehung setzt zur Höhe der aufgewendeten Fördermittel. </p>

Robot Adoption at German Plants

in: Jahrbücher für Nationalökonomie und Statistik, No. 3, 2024

Abstract

Using a newly collected dataset at the plant level from 2014 to 2018, we provide the first microscopic portrait of robotization in Germany and study the correlates of robot adoption. Our descriptive analysis uncovers five stylized facts: (1) Robot use is relatively rare. (2) The distribution of robots is highly skewed. (3) New robot adopters contribute substantially to the recent robotization. (4) Robot users are exceptional. (5) Heterogeneity in robot types matters. Our regression results further suggest plant size, high-skilled labor share, exporter status, and labor shortage to be strongly associated with the future probability of robot adoption.

Do Politicians Affect Firm Outcomes? Evidence from Connections to the German Federal Parliament

in: IWH Discussion Papers, No. 15, 2024

Abstract

<p>We study how connections to German federal parliamentarians affect firm dynamics by constructing a novel dataset linking politicians and election candidates to the universe of firms. To identify the causal effect of access to political power, we exploit (i) new appointments to the company leadership team and (ii) discontinuities around the marginal seat of party election lists. Our results reveal that connections lead to reductions in firm exits, gradual increases in employment growth without improvements in productivity. Adding information on credit ratings, subsidies and procurement contracts allows us to distinguish between mechanisms driving the effects over the politician’s career.</p>